A strategic partnership is reshaping the global tech supply chain: United Microelectronics Corporation (UMC), the world’s second-largest foundry, is deepening ties with Unimicron Technology, a global leader in advanced printed circuit boards (PCBs) and substrates, through a NT$700 million capital injection.

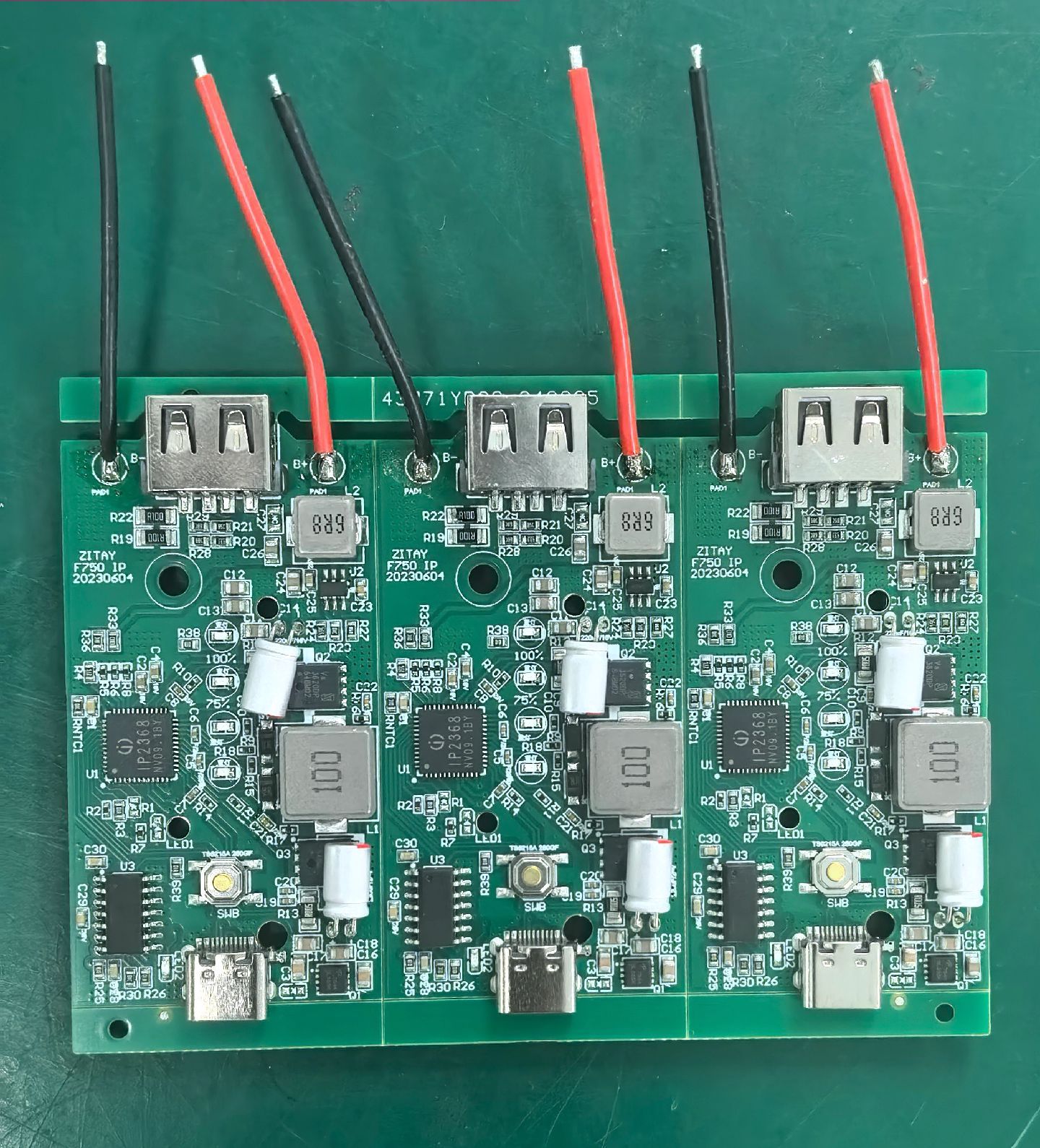

Announced jointly on December 17, 2025, the collaboration marks a pivotal step in integrating semiconductor and PCB ecosystems. UMC will subscribe to Unimicron’s shares at NT$116 apiece, securing up to 6.03 million new shares—raising its stake from 12.68% to 13.01%. Complementing this, Unimicron plans a NT$15 billion unsecured corporate bond issuance alongside a NT$4.6 billion common stock placement, unlocking total funding of approximately RMB3.58 billion. The capital will fuel high-end PCB capacity expansion, technological R&D, and operational liquidity.

Why This Alliance Matters for the AI Era

The partnership is strategically aligned with surging demand for advanced manufacturing in AI and high-performance computing (HPC):

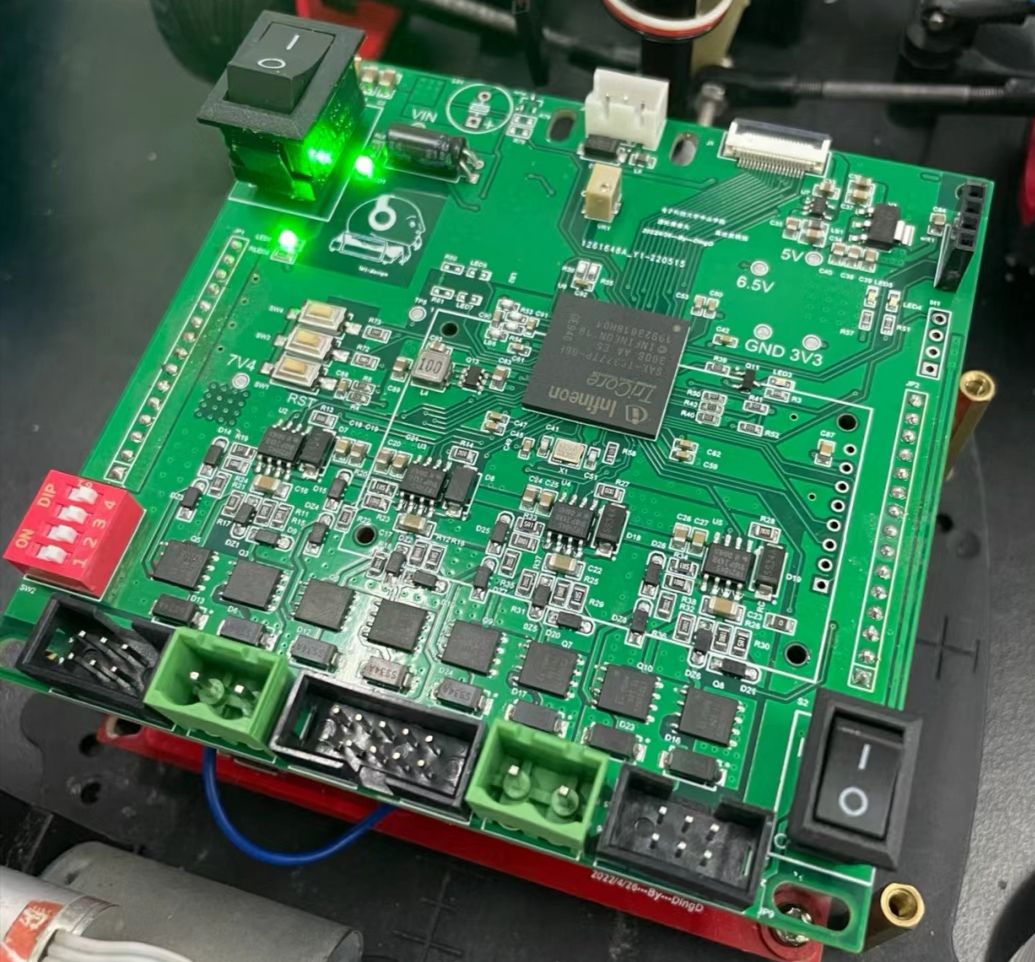

- UMC’s Ecosystem Play: By anchoring Unimicron in its advanced packaging supply chain, UMC strengthens the "wafer fabrication + PCB/substrate + assembly/test" value chain—directly addressing capacity constraints in TSMC’s CoWoS (Chip on Wafer on Substrate) technology.

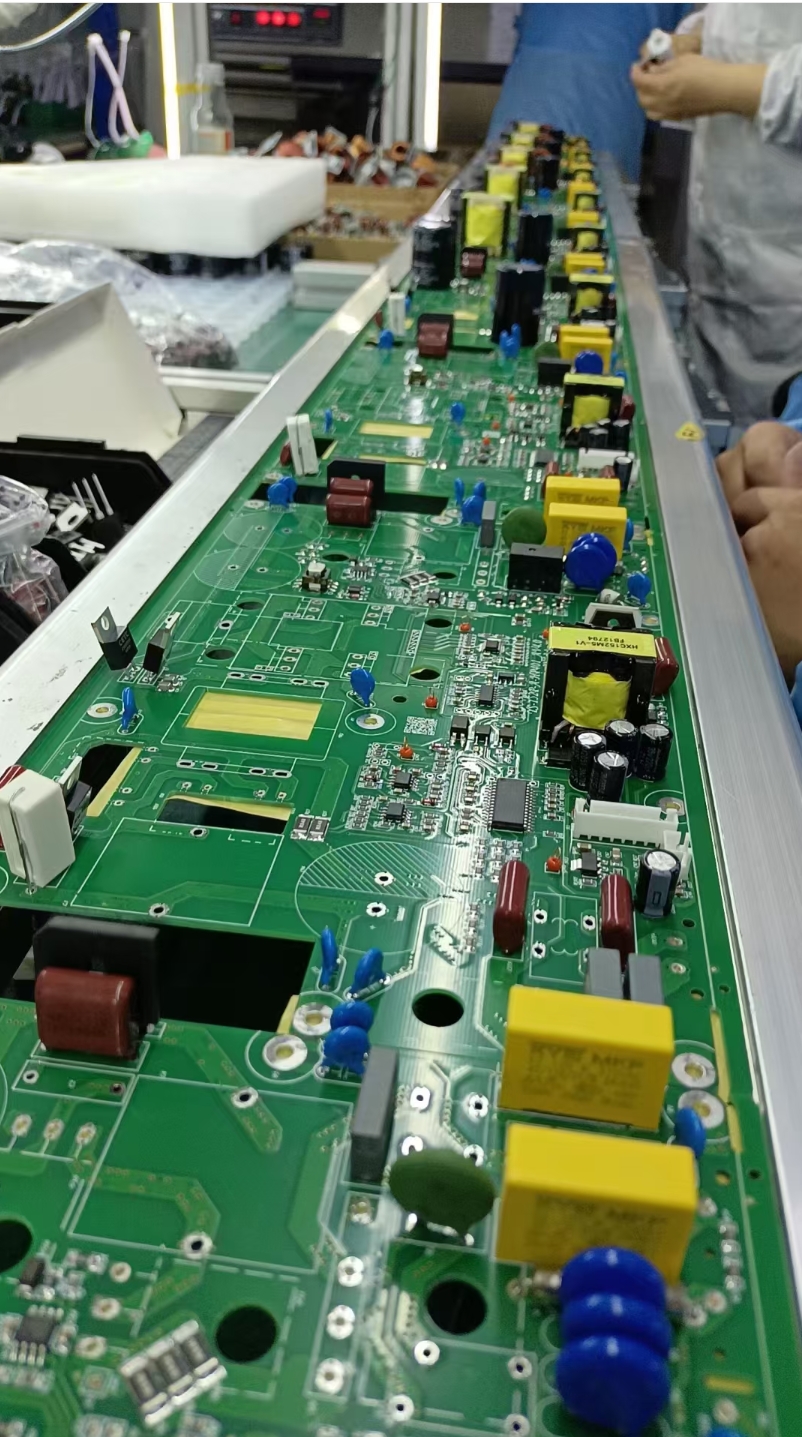

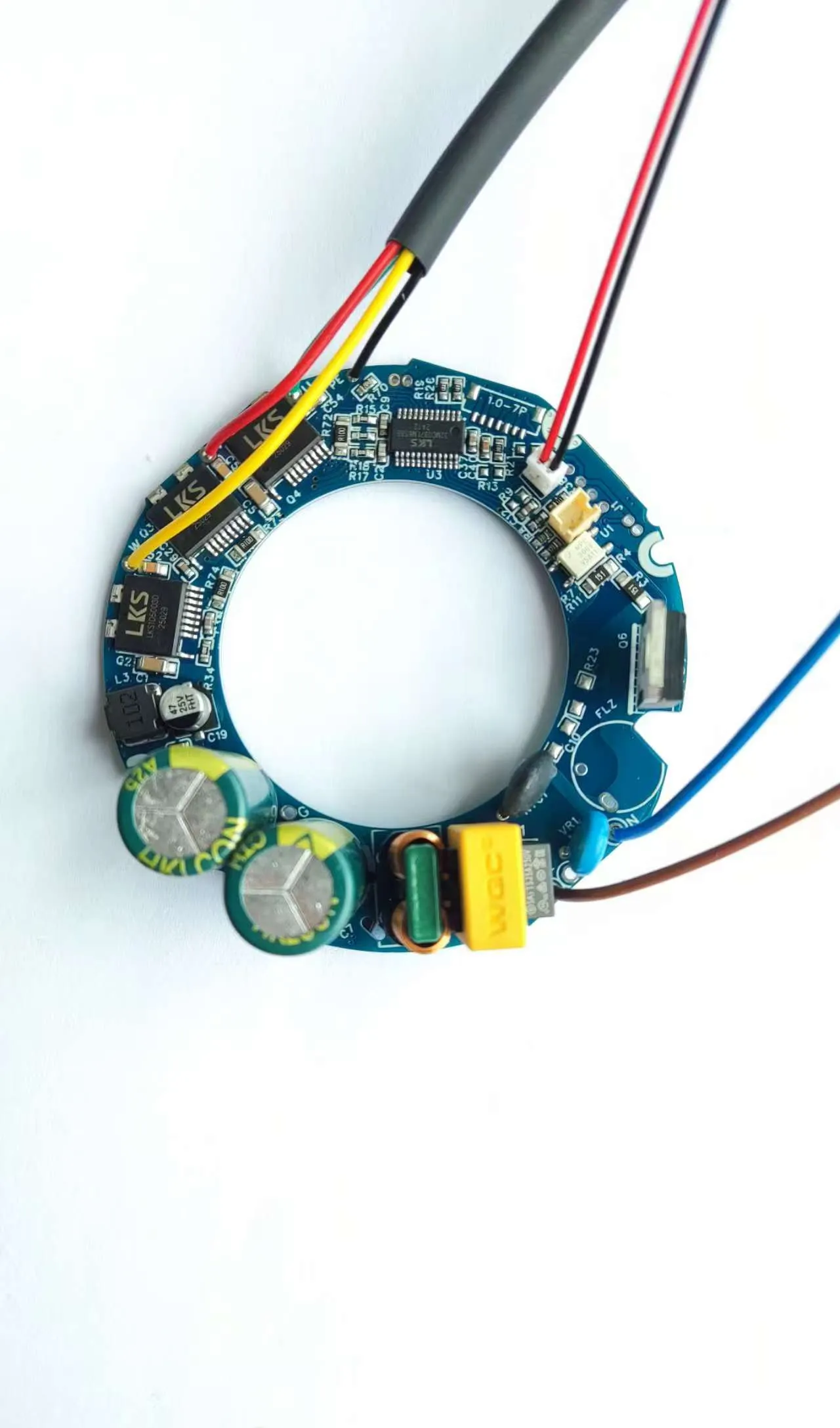

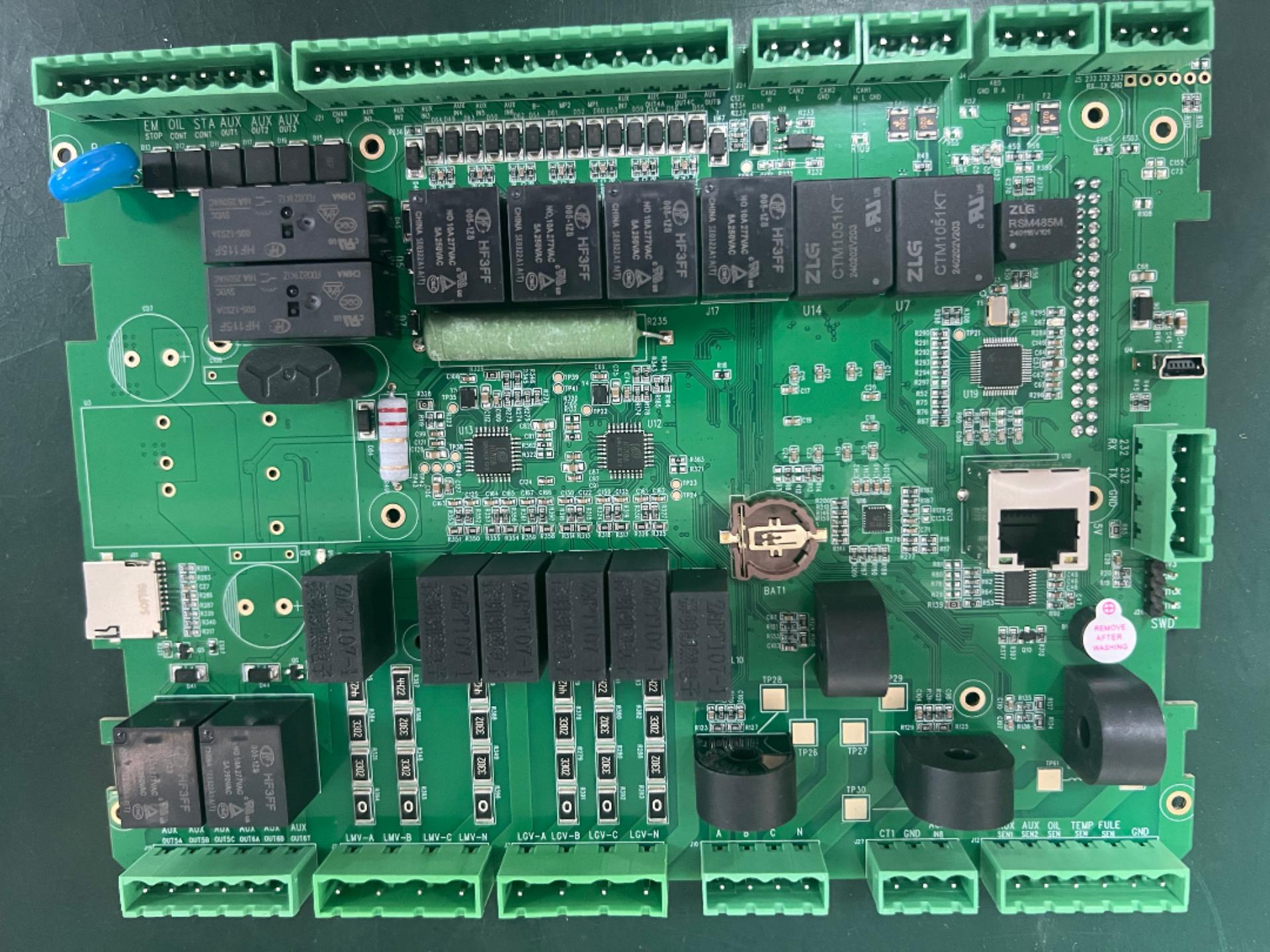

- Unimicron’s Tech Leap: Leveraging UMC’s semiconductor expertise, Unimicron will accelerate R&D in cutting-edge solutions: MSAP (Modified Semi-Additive Process) technology, ABF (Ajinomoto Build-up Film) substrates, and high-layer count PCBs for AI servers. This reinforces its leadership in HDI (High-Density Interconnect) technology for GB200 compute boards while tapping UMC’s client base to expand in AI chips and HPC markets.

Market and Industry Ripple Effects

The collaboration has already garnered strong market response: Unimicron’s stock surged 8.7% over three consecutive trading days post-announcement, with top investment banks including Goldman Sachs and Morgan Stanley upgrading their target prices and maintaining "Buy" ratings.

Beyond short-term market optimism, the alliance is set to drive broader industry transformation:

- Elevating technical standards for high-end PCBs and substrates globally;

- Fostering a robust "semiconductor + PCB" industrial cluster in Taiwan;

- Boosting demand for upstream materials such as ABF resin and high-performance glass fiber cloth;

- Delivering more stable and integrated supply chain support for the AI server ecosystem.

As AI and HPC continue to redefine tech infrastructure, strategic synergies between semiconductor and PCB leaders will be critical to unlocking next-generation innovation.