Goldman Sachs' Research on DEER Technology: From General Servers to AI, the Upgrading Battle of China's PCB Industry

The Asian analyst team of Goldman Sachs, a world-renowned top investment bank, recently launched the "China PCB Tour Research". On January 23, they visited the Guangzhou production base of DEER Technology, a listed company on the A-share market, and conducted in-depth exchanges with the company's management. The research report released two days later not only outlined DEER Technology's clear layout targeting the AI server PCB track, but also reflected the crucial strategic upgrading of China's high-end manufacturing in the core hardware field. Behind this is the epic growth opportunity of the PCB industry driven by the global AI computing power wave.

Core Conclusion: Seizing the 140% CAGR Tidal Wave, DEER Technology Forcibly Enters the AI Server PCB Market

Goldman Sachs gave a clear judgment in this research: Relying on its profound technological and production capacity accumulation in the general server PCB field, DEER Technology is firmly cutting into the high-value AI server PCB market. The company's management has a resolute attitude towards capacity expansion, accurately seizing the product specification upgrading and market growth dividends brought by AI servers.

This layout is perfectly aligned with the outbreak period of the global AI server PCB market. Goldman Sachs predicted earlier that the compound annual growth rate of the global AI server PCB market will reach as high as 140% from 2025 to 2027, and the market scale will exceed 27 billion US dollars in 2027. DEER Technology's strategic upgrading is in step with this super tidal wave.

Simultaneous Capacity Expansion in Dual Bases: Guangzhou Targets High-End, Thailand Becomes an International Bridgehead

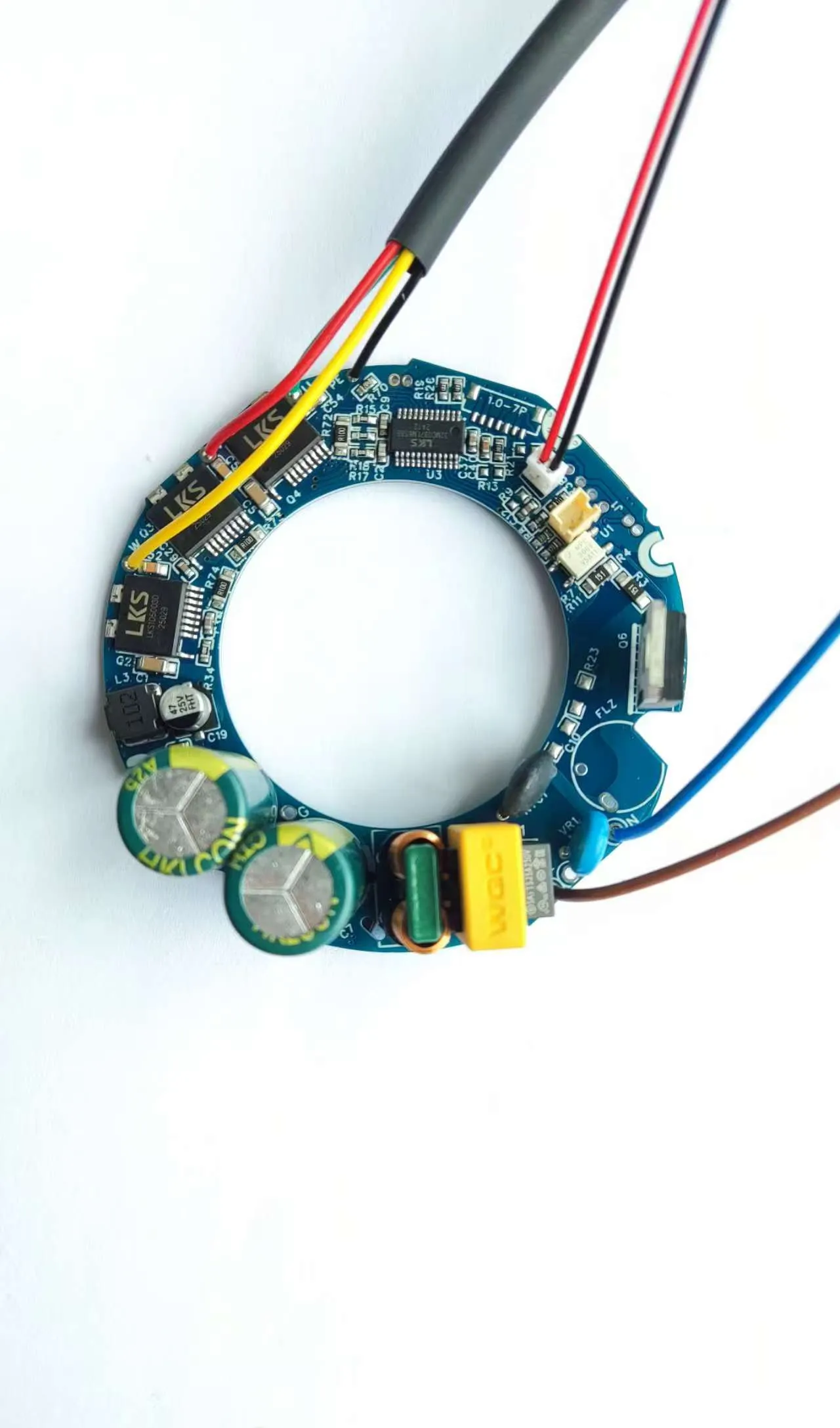

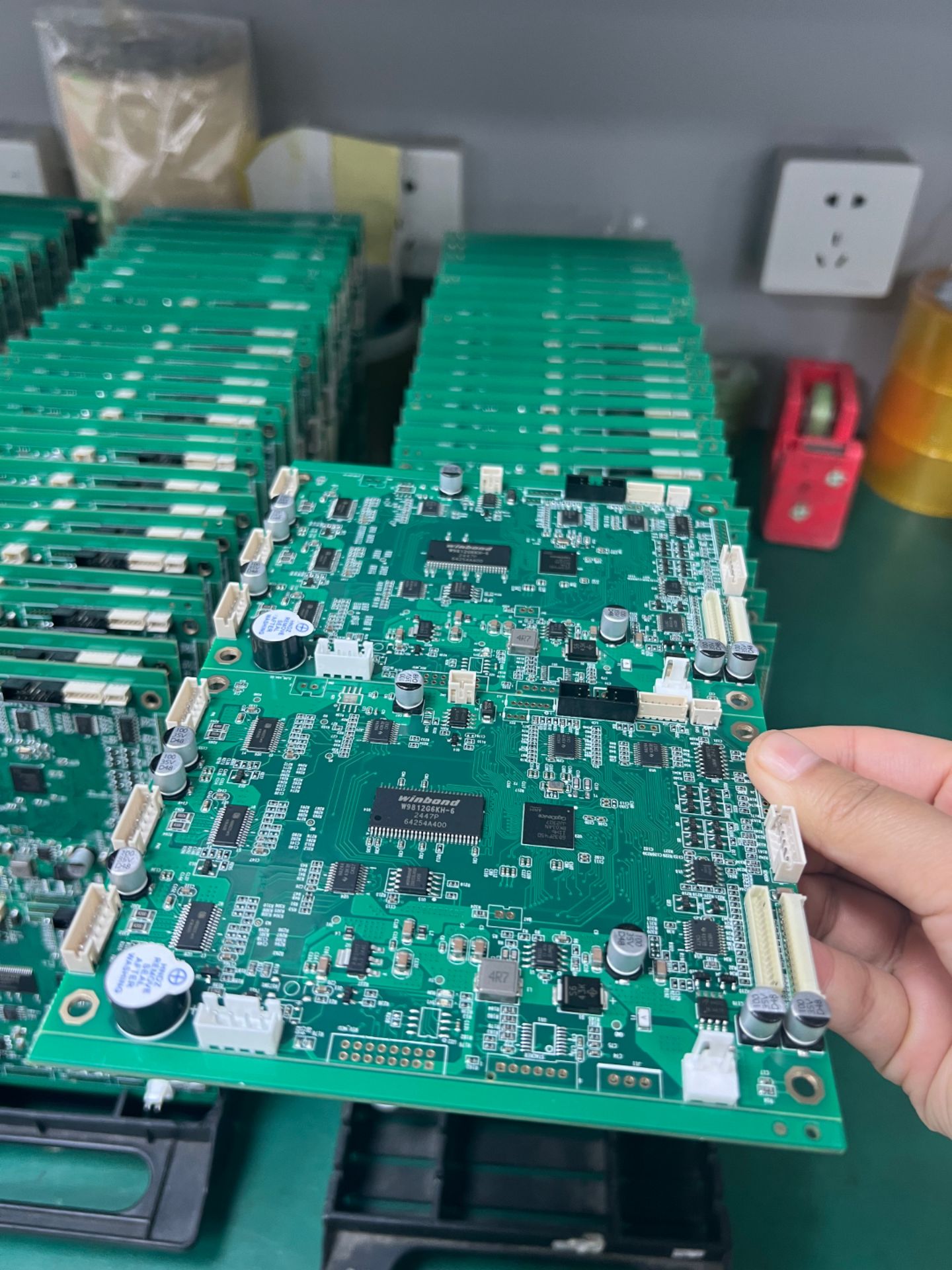

As a global manufacturing enterprise, DEER Technology has built a coordinated development pattern of dual bases in Guangzhou, China and Thailand. The two production centers are advancing capacity expansion simultaneously, becoming the core engine of the company's growth in the next three years.

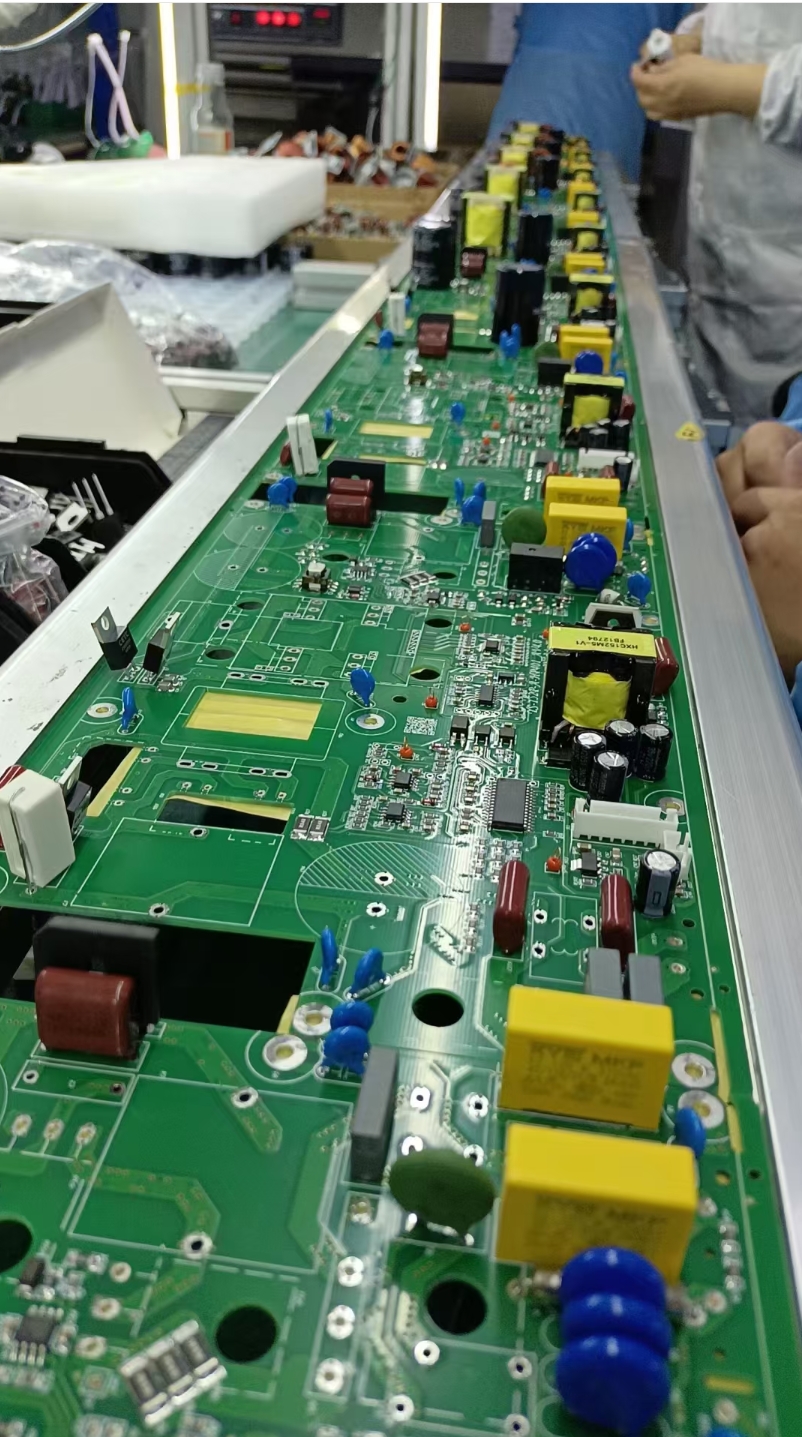

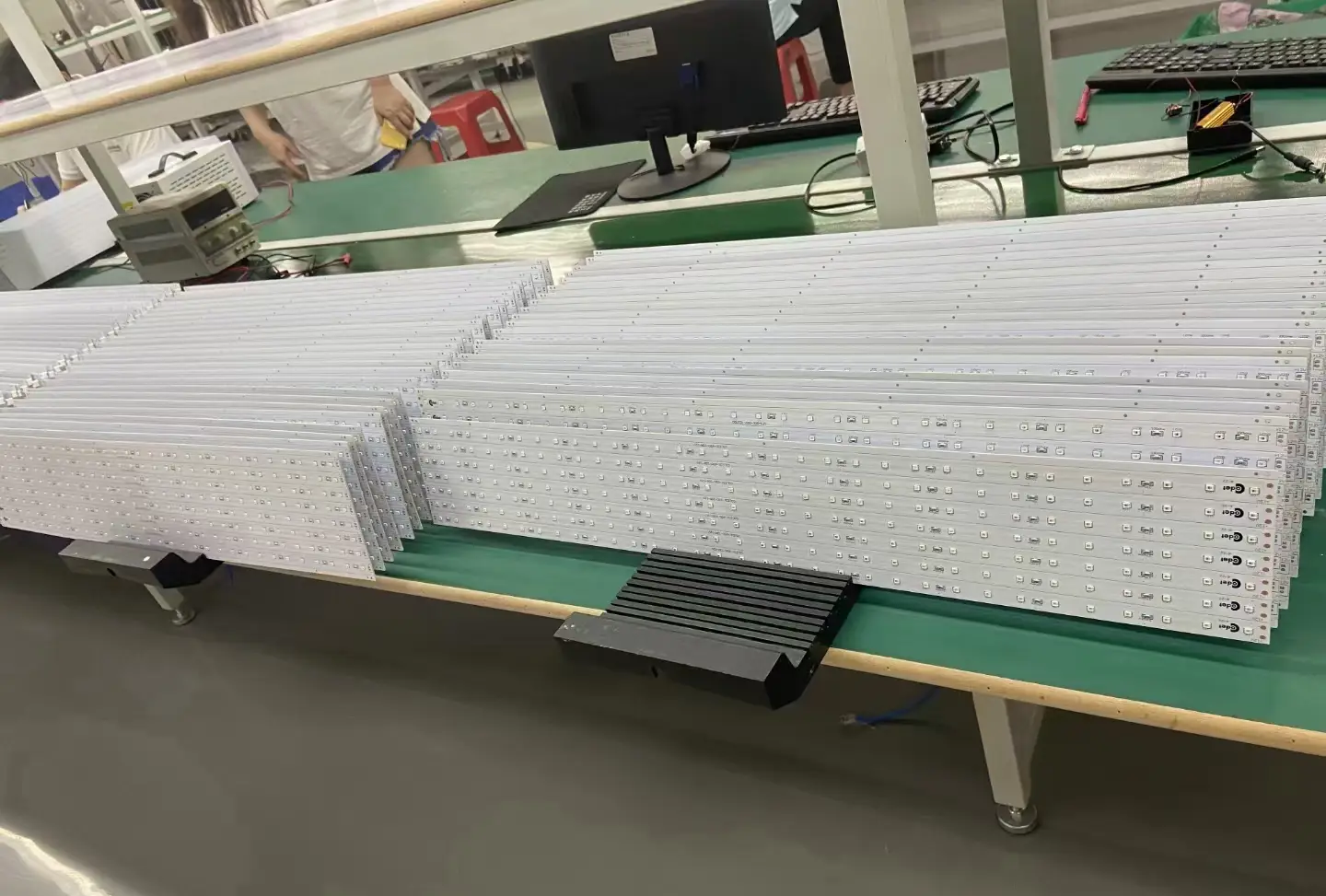

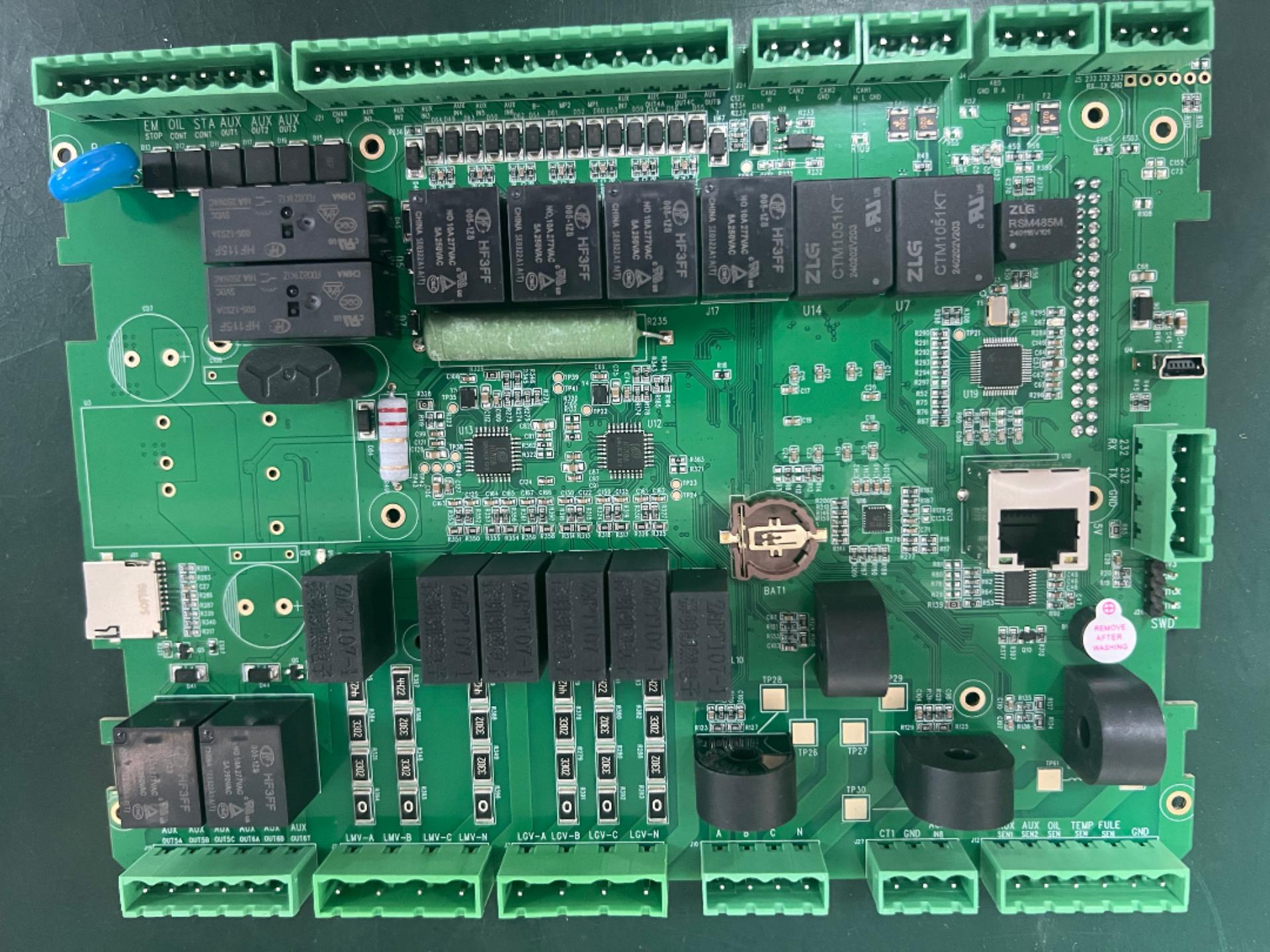

Guangzhou Base: An Exclusive Manufacturing Center for High-End AI PCBs

The third factory of DEER Technology in Guangzhou officially started construction in August 2025. Different from conventional production lines, this factory is built exclusively for AI servers, focusing on the production of high-layer PCBs with an average of 22 layers and HDI boards. It is expected to achieve mass production in the fourth quarter of 2026 and become a new growth pole of the company's revenue in 2027.

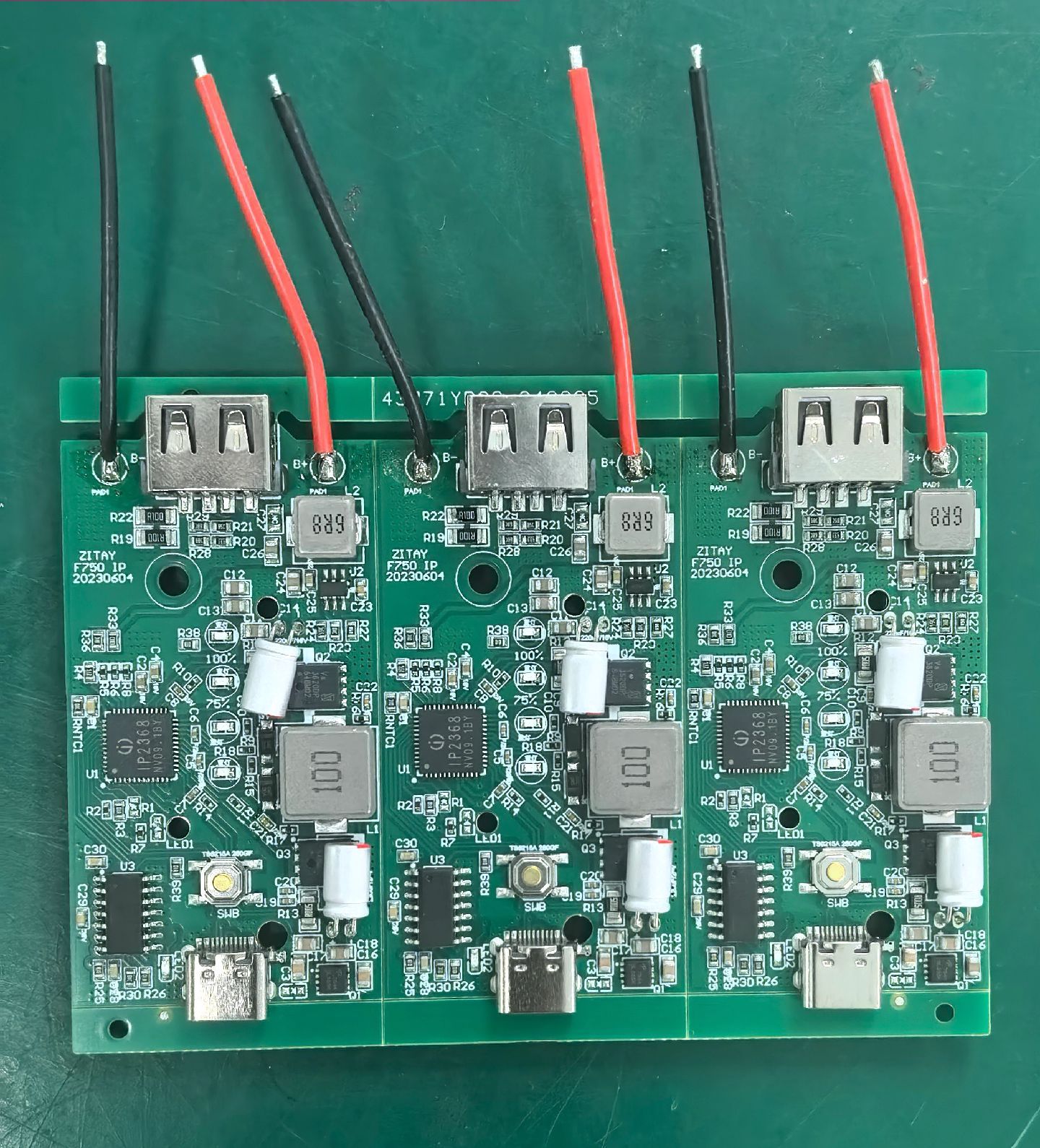

Thailand Base: Exceeding Market Expectations in Progress, Rapidly Realizing Profit and Production Capacity

The landing pace of the Thailand factory has far exceeded market expectations, successfully achieving mass production in June 2025 and reaching the profit target in December of the same year. The first-phase production capacity of the factory will be fully released by the end of 2026, and the second-phase production capacity layout is planned to contribute stable revenue to the company in 2027, becoming an important bridgehead for DEER Technology to explore the overseas market.

Consolidating the Basic Disk: General Servers Usher in Double-Digit Growth, Technological Iteration Lifts Product Value

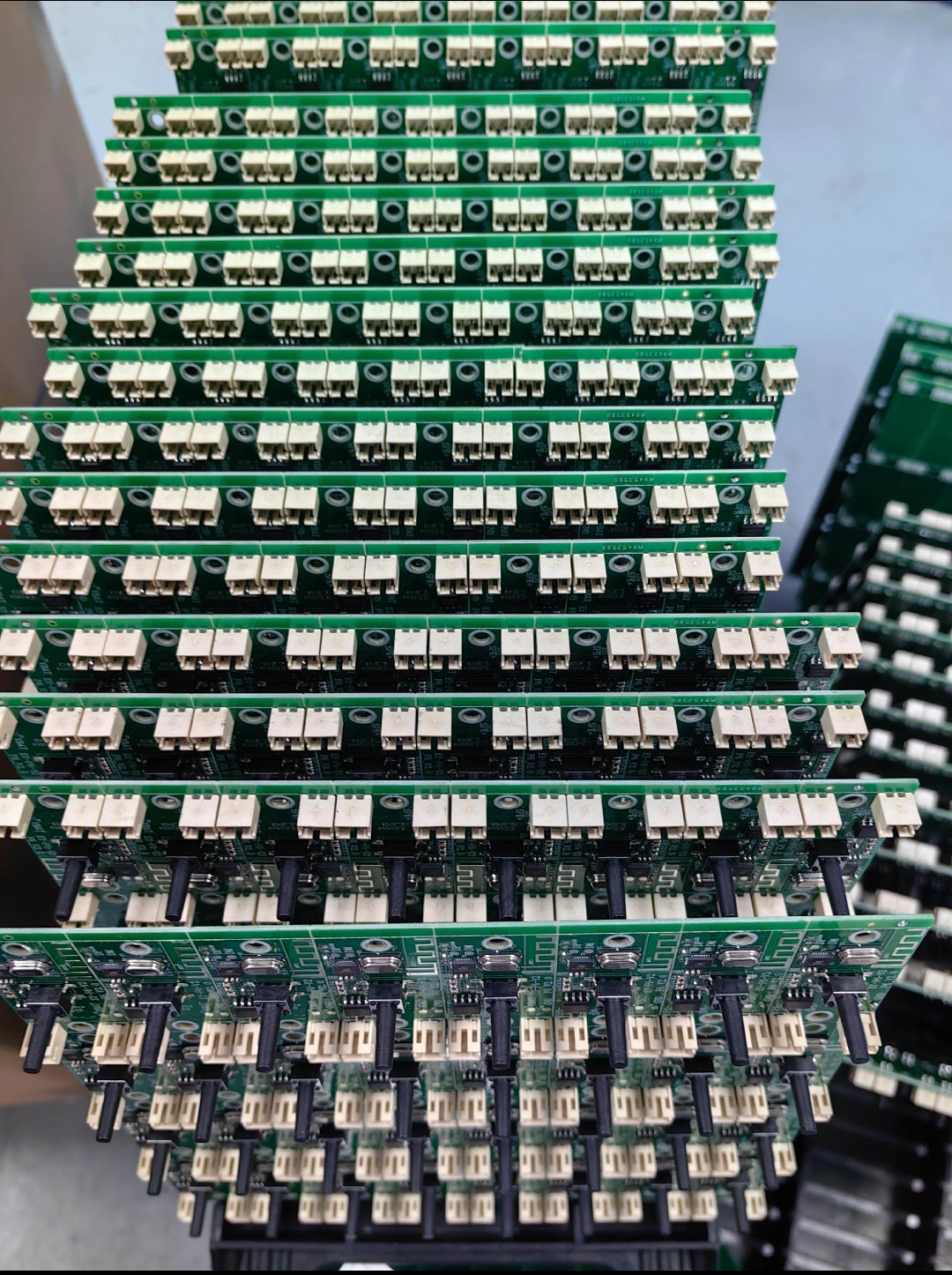

DEER Technology is a core global supplier of general server PCBs, deeply serving major mainstream brands. At present, this business is still the ballast stone of the company's revenue, while the proportion of AI-related businesses is continuously and rapidly increasing.

The company's management stated that the global shipment of general servers is expected to achieve double-digit growth in 2026, far exceeding the previous average annual growth rate of 3-5%. Sufficient on-hand orders have become a solid support for this judgment. More importantly, general servers are ushering in the dividend of technological iteration: the evolution from PCIe 5.0 to 6.0 directly drives the upgrading of PCB products to higher-layer M7/M8 specifications, and the average unit price of products increases simultaneously. This logic will become the core support for the company's performance growth in 2026, enabling the general server business to realize value improvement while stabilizing the foundation.

Targeting the Main Battlefield: AI Server PCB Becomes a High-Profit Growth Pole, Binding with the Head Supply Chain

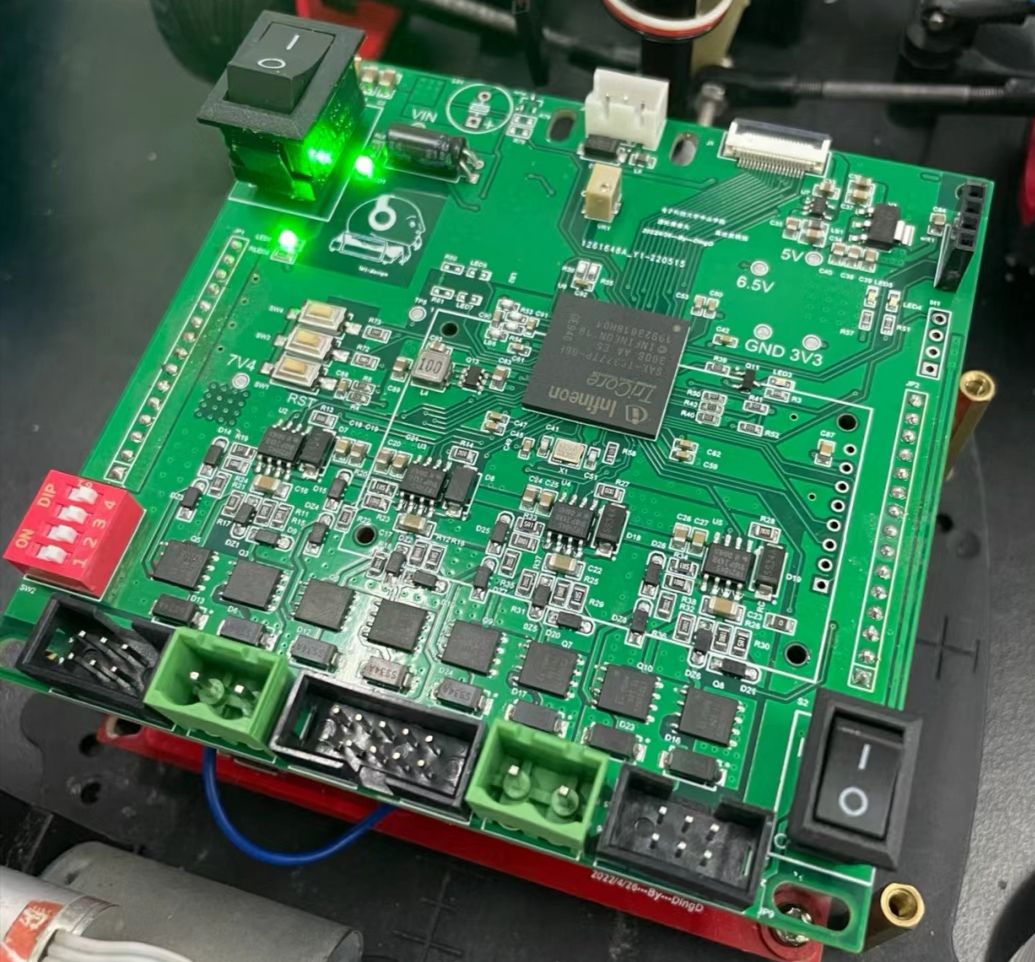

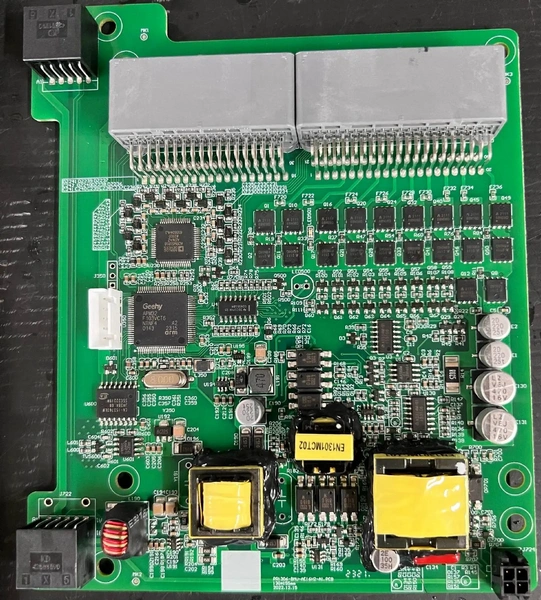

If the general server PCB is the company's cash cow business, then the AI server PCB is a new profit gold mine for DEER Technology. The company's management clearly disclosed that the gross profit margin of AI server PCB products is 5-6 percentage points higher than that of general servers, which is also the core driving force for the company's strategic tilt towards the AI track.

DEER Technology's layout of AI server PCBs does not start from scratch: relying on the deep trust established through long-term cooperation with Taiwanese ODM manufacturers in the general server field, the company is naturally extending the cooperative relationship to the AI server PCB supply system, targeting the supply chain of leading North American cloud service providers. In view of the complex internal structure of AI servers, DEER Technology has accurately targeted high-value core products such as UBB boards, OAM module boards, and switch motherboards, and continuously broken through the high-end market.

Goldman Sachs' Macro Perspective: Three Core Driving Forces Unleash the Vast Future of the PCB Industry

Combining the micro observations of this factory research and the macro judgment of the industry, Goldman Sachs pointed out that three core driving forces are pushing the global AI server PCB market to an explosive growth, and the industry development is ushering in a vast future:

1. The blowout demand for high-end AI servers, and the computing power arms race drives a sharp surge in demand for core hardware;

2. The continuous upgrading of PCB product technical specifications, and the improvement of layer and process requirements drives the restructuring of product value;

3. The sustained expansion of capital expenditure by global cloud manufacturers provides long-term demand support for the upstream PCB industry.

Industrial Trend: Under the AI Computing Power Wave, Upstream PCB Core Suppliers Usher in Valuation Reassessment

Goldman Sachs' factory visit to DEER Technology is not only an in-depth research on a single enterprise, but also reveals the core industrial trend in the AI era: under the wave of the global AI computing power arms race, upstream core hardware suppliers are ushering in a new round of valuation reassessment. As a key component of computing power infrastructure, the technological upgrading and capacity expansion of the PCB industry will continue to provide underlying support for the development of AI computing power. Enterprises that take the lead in completing track layout and achieving technological breakthroughs will seize the opportunity in the industry outbreak.