As reported by Taiwan’s Commercial Times, leading copper-clad laminate (CCL) manufacturer Kingboard has issued a new price hike notice, announcing a 10% overall price increase for newly received orders. The move comes as surging copper prices and tight supply of electronic-grade glass cloth have created unsustainable cost pressures.

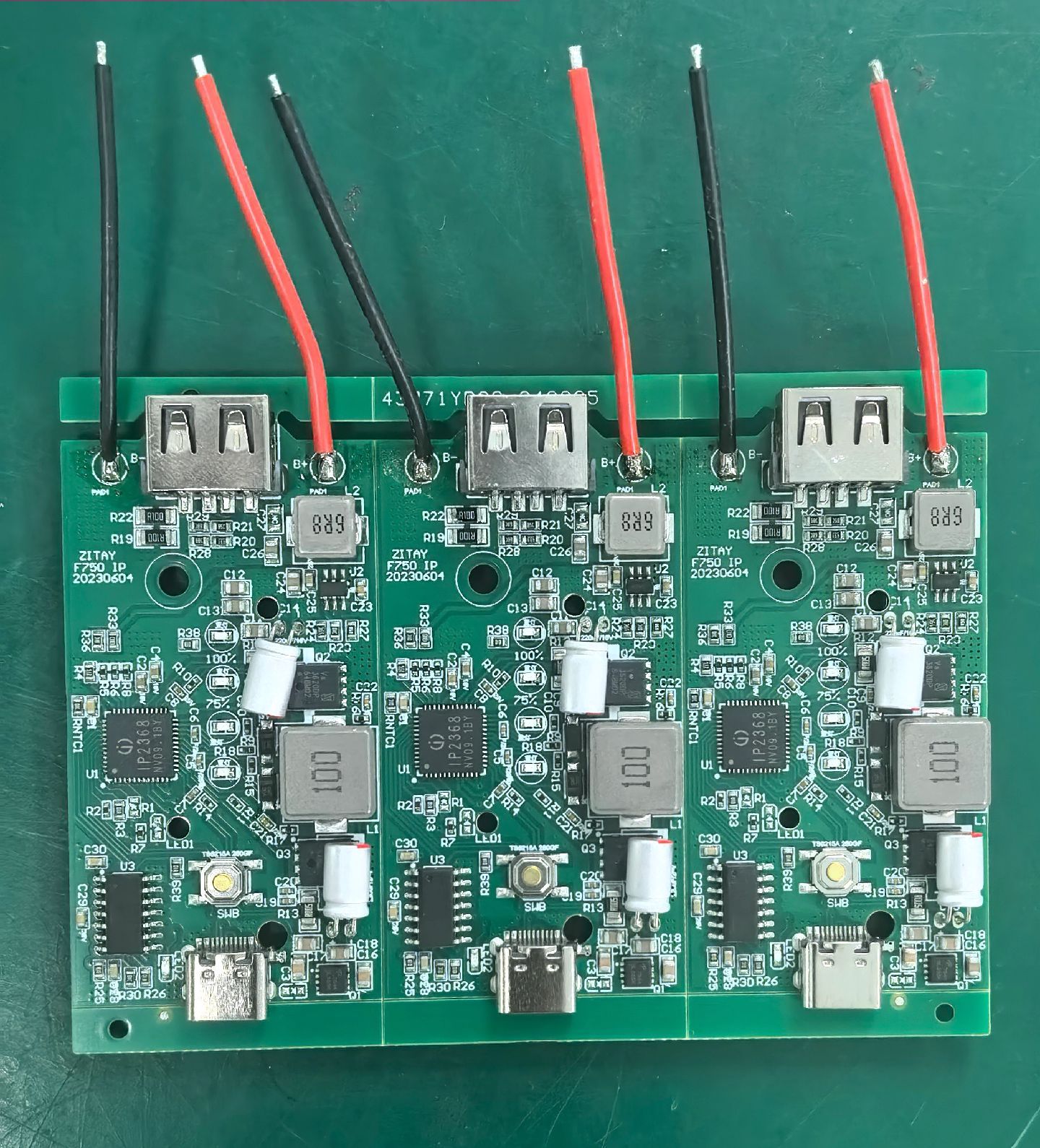

This marks Kingboard’s third price adjustment in the second half of the year. Following targeted hikes for mid-to-low-end CCL grades (e.g., CEM-1, FR-4) in August and a 5%-10% increase for CEM series, mid-to-high-end FR-4, and PP materials earlier this month, the latest round underscores the industry-wide cost squeeze.

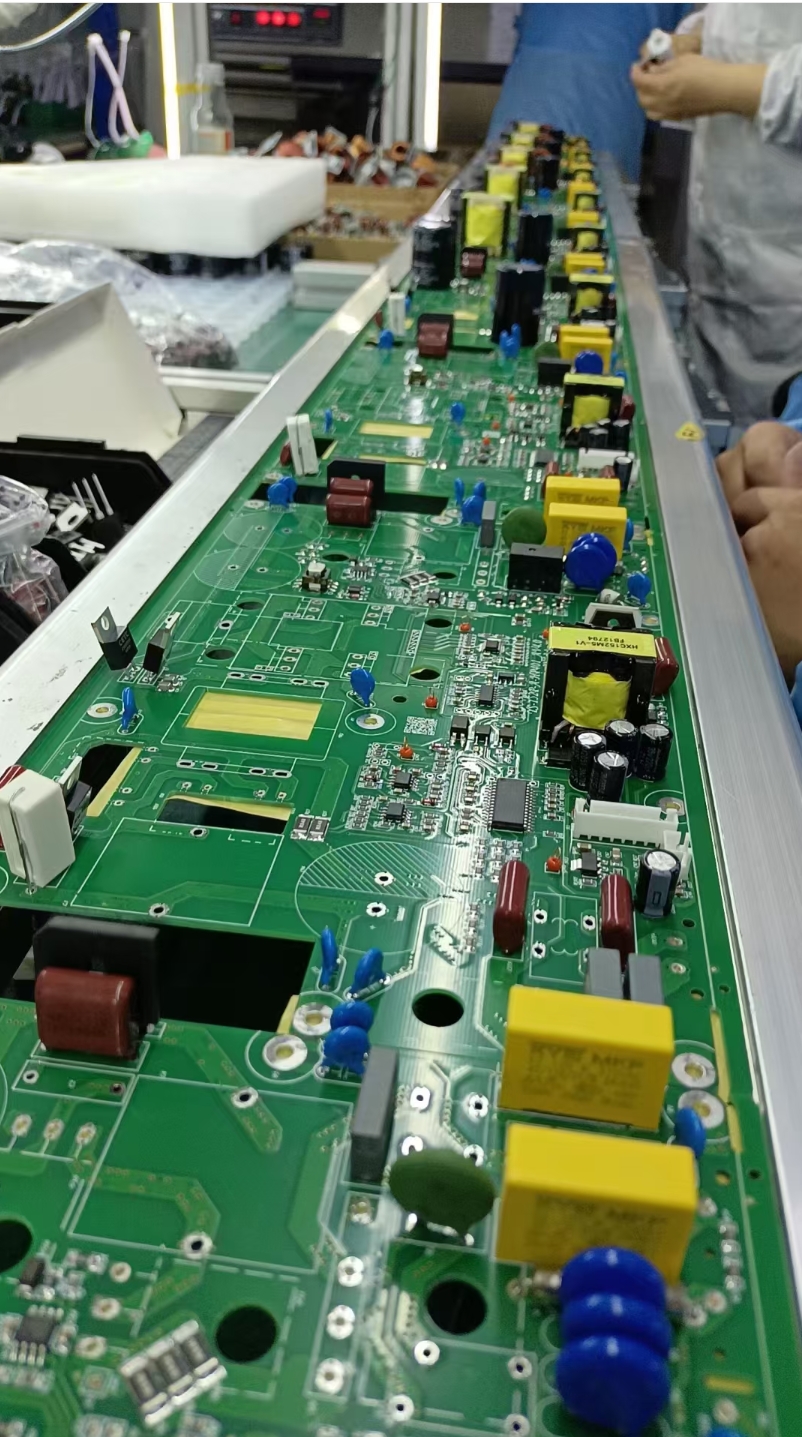

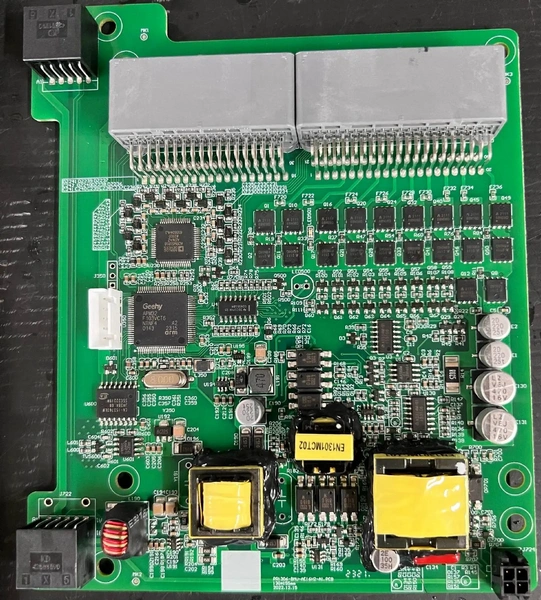

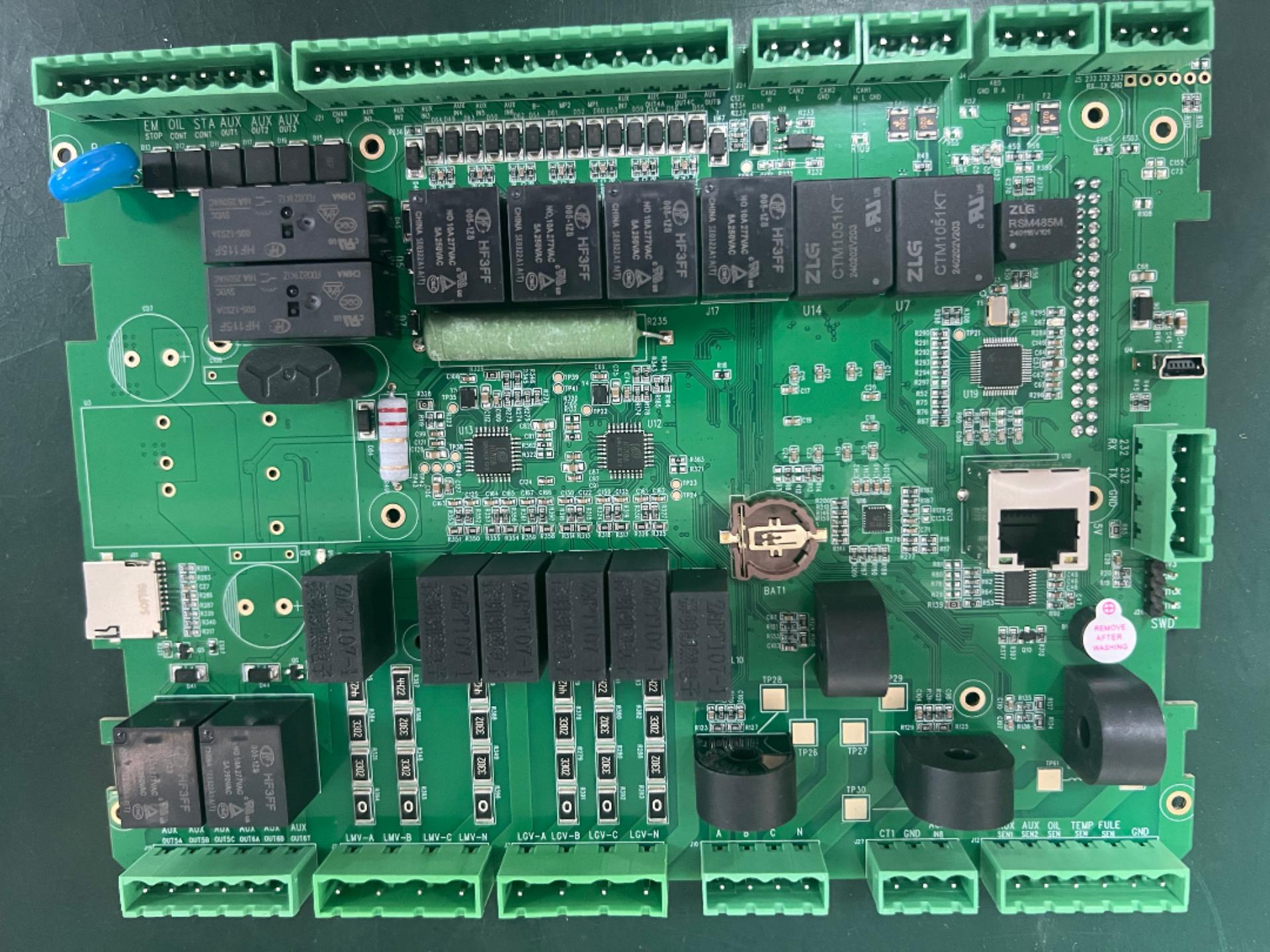

CCL, the core substrate for printed circuit boards (PCB), is experiencing a dual boost in technology and pricing fueled by the rapid iteration of AI servers. A key driver behind the price surge is the strained supply of upstream raw materials: electronic glass cloth capacity remains insufficient, with suppliers like Philip Glass, International Composite Materials, and Nittobo ramping up production—though new capacity requires 1–2 years of validation and faces bottlenecks in switching production lines (e.g., a 30%–40% output reduction when shifting from LDK1 to Q cloth). Glass cloth prices jumped 20% in 2024, and another 20% cumulative increase is expected in 2026 across three rounds of hikes.

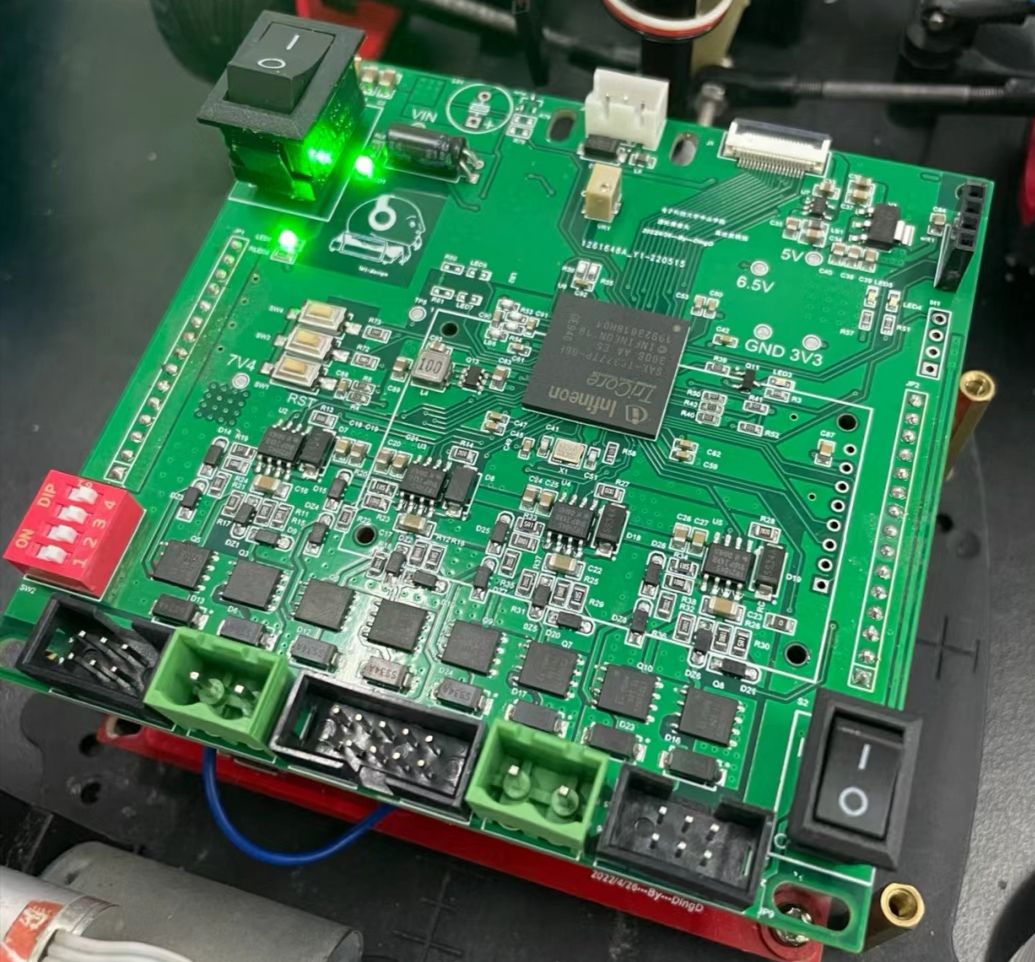

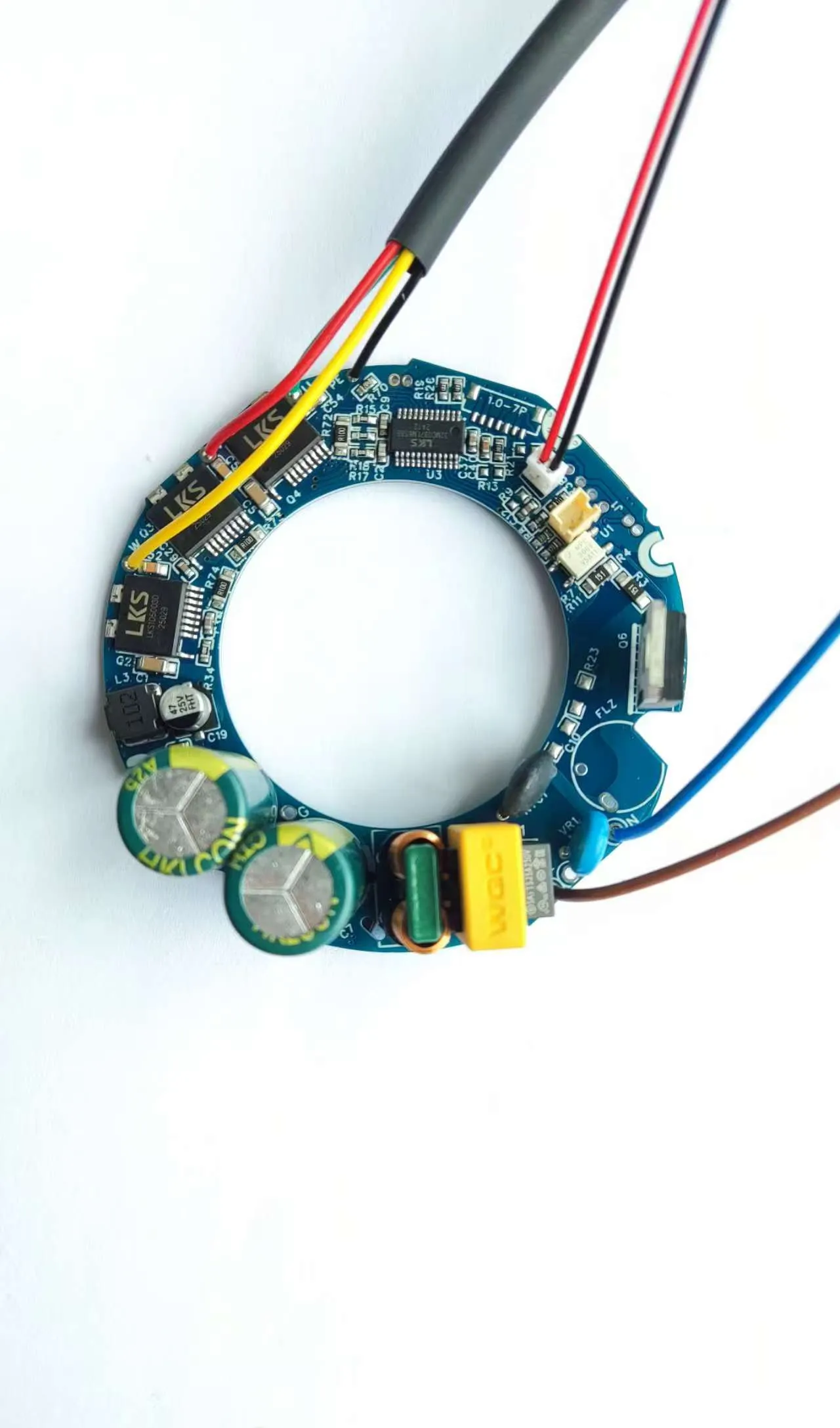

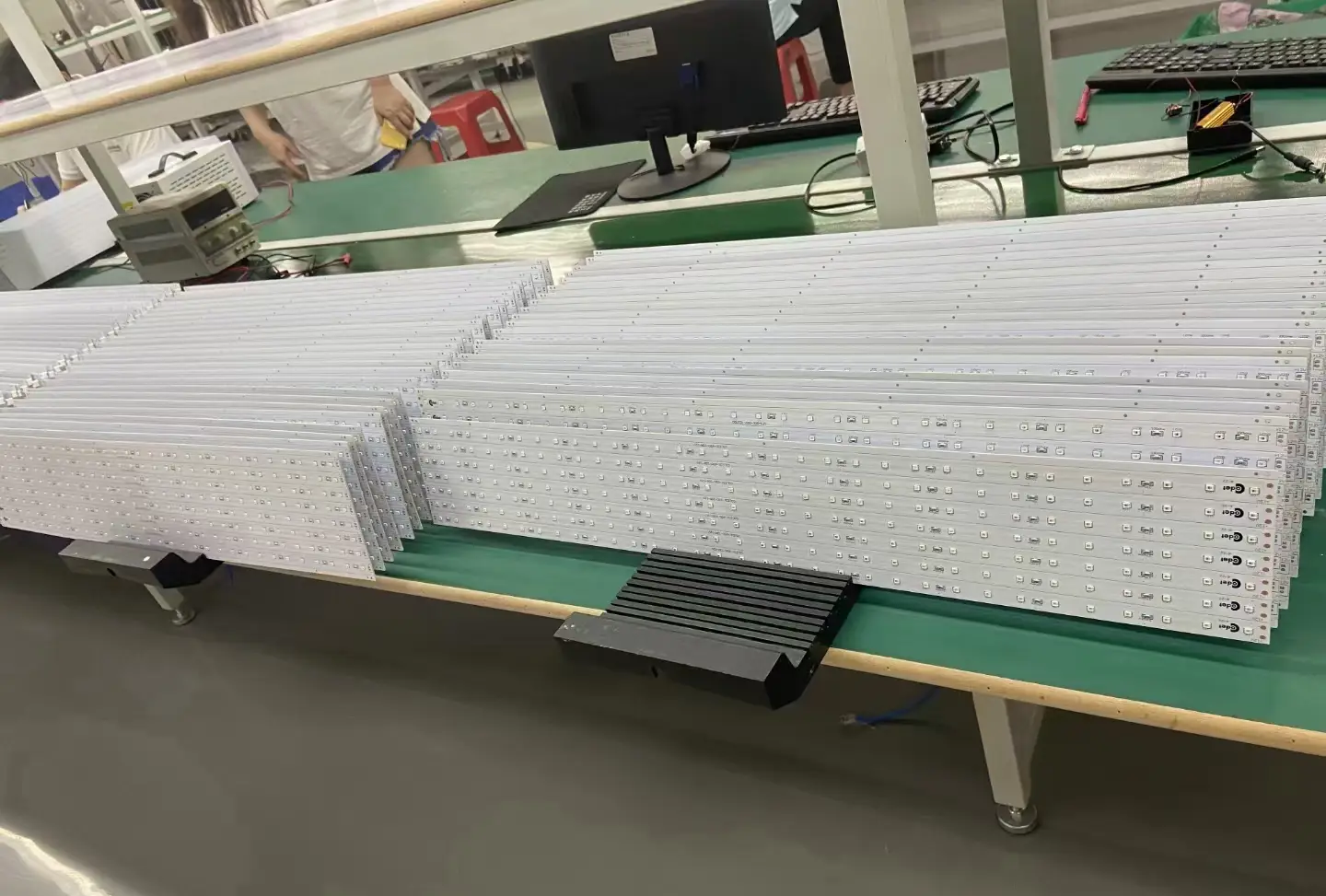

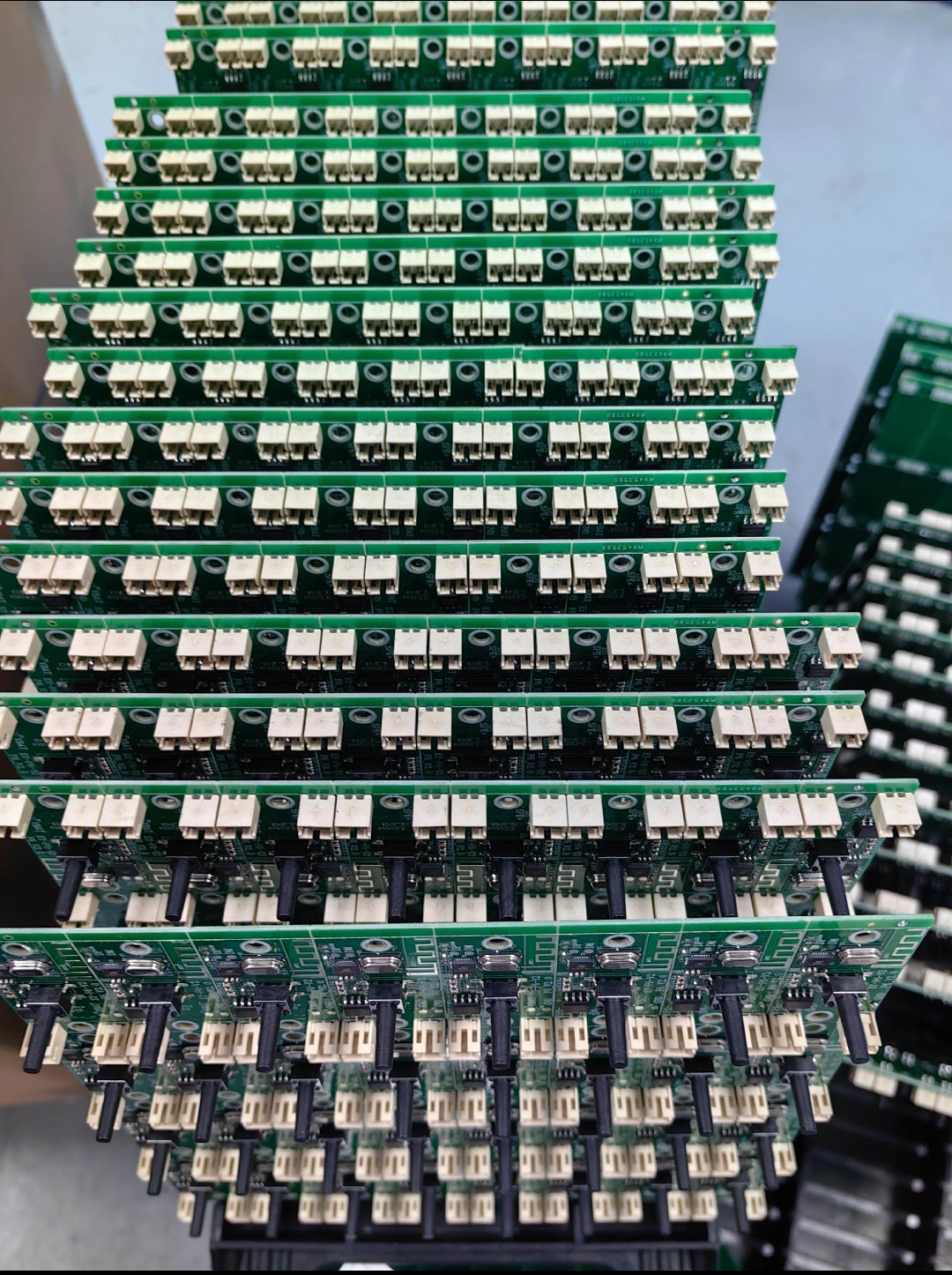

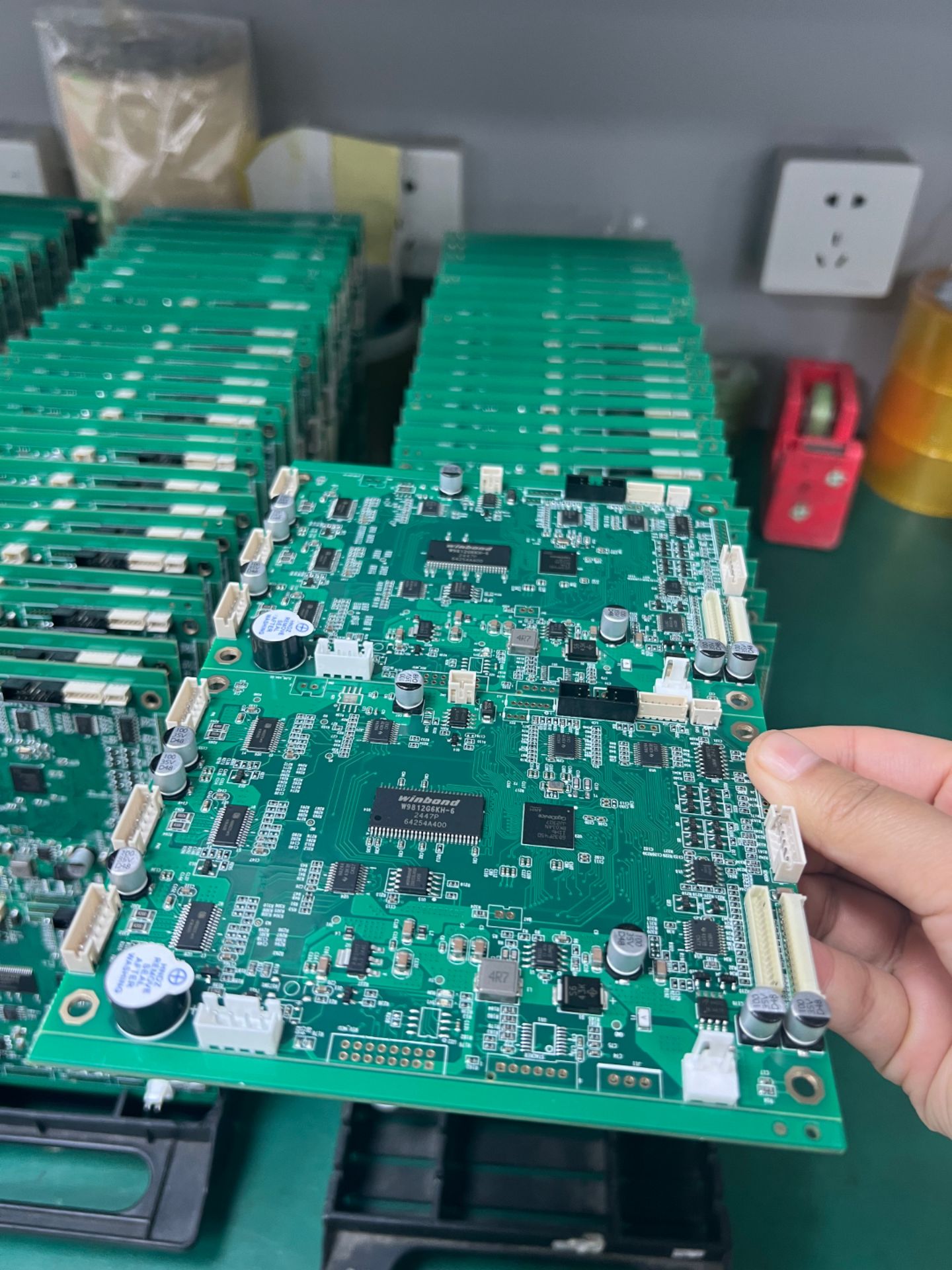

The AI boom is reshaping demand dynamics for PCB and CCL. High-performance computing devices and edge computing terminals are pushing for advanced PCB with superior performance, density, and reliability. Leading PCB players including WUS Printed Circuit, Shengyi Electronics, and Shennan Circuits have announced expansion plans totaling over RMB 30 billion to meet surging demand.

Material upgrades are also gaining momentum. The shift toward low dielectric constant (Low-Dk) and low coefficient of thermal expansion (Low-CTE) glass cloth—such as T-Glass and Q cloth—is accelerating, driven by AI servers’ stringent signal transmission requirements. High-end CCL grades are evolving from M7/M8 to M9, with Nvidia’s upcoming Vera Rubin 200 platform and Google’s new TPU products expected to drive explosive growth in M9 demand over the next three years.

Industry analysts point out that price hikes will be the main theme for the CCL sector in 2025–2026. Three factors—rising costs of copper and glass cloth, capacity diversion to high-end AI-related production, and low PCB inventory levels—will sustain the upward pricing trend. For upstream suppliers, the shift toward high-end materials presents opportunities to capture greater market share amid tight supply of low-Dk cloth and Q cloth.

10203 View