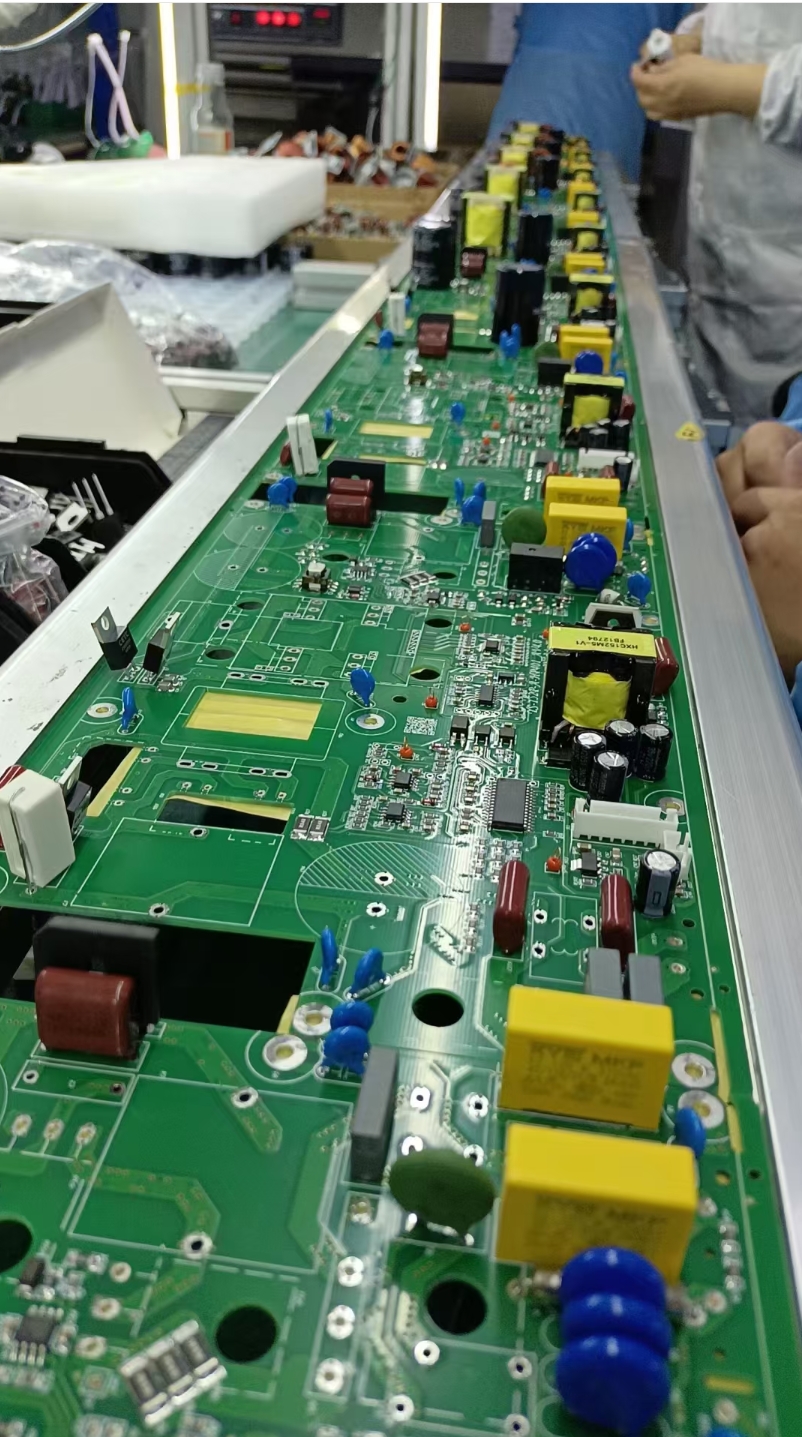

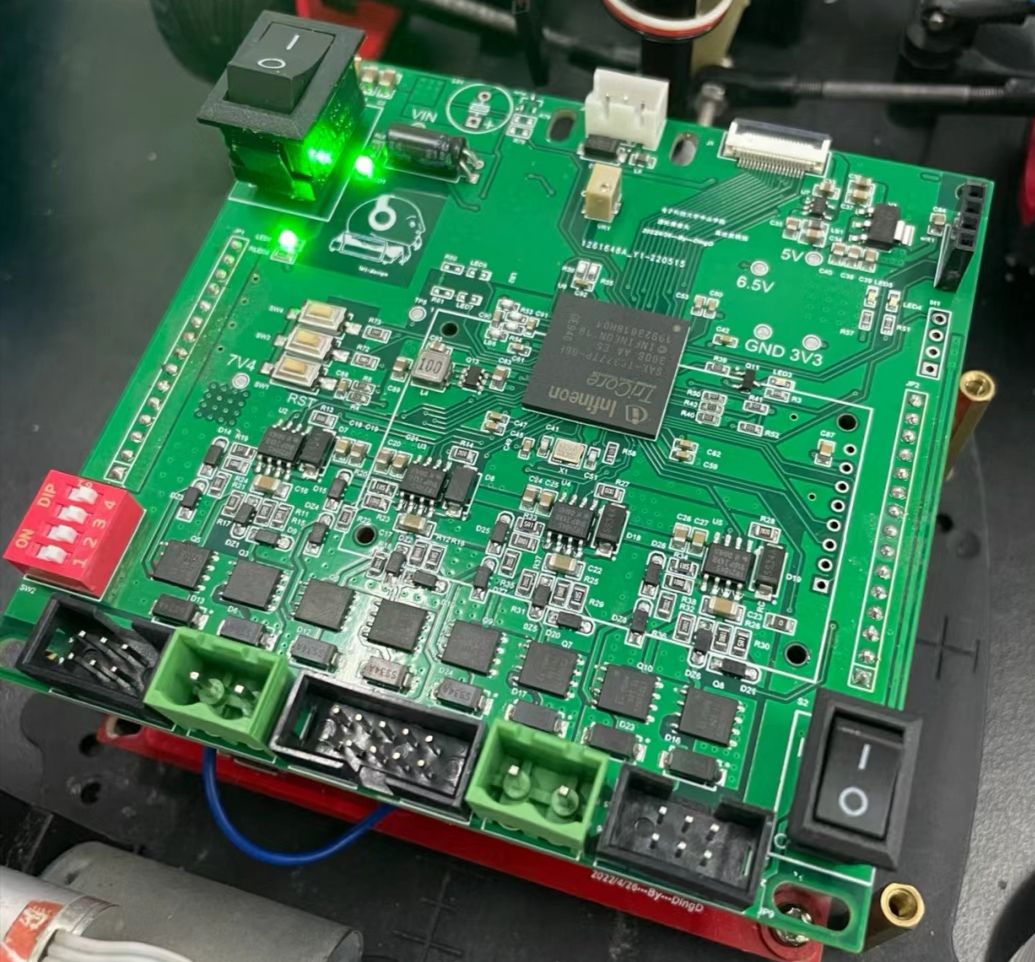

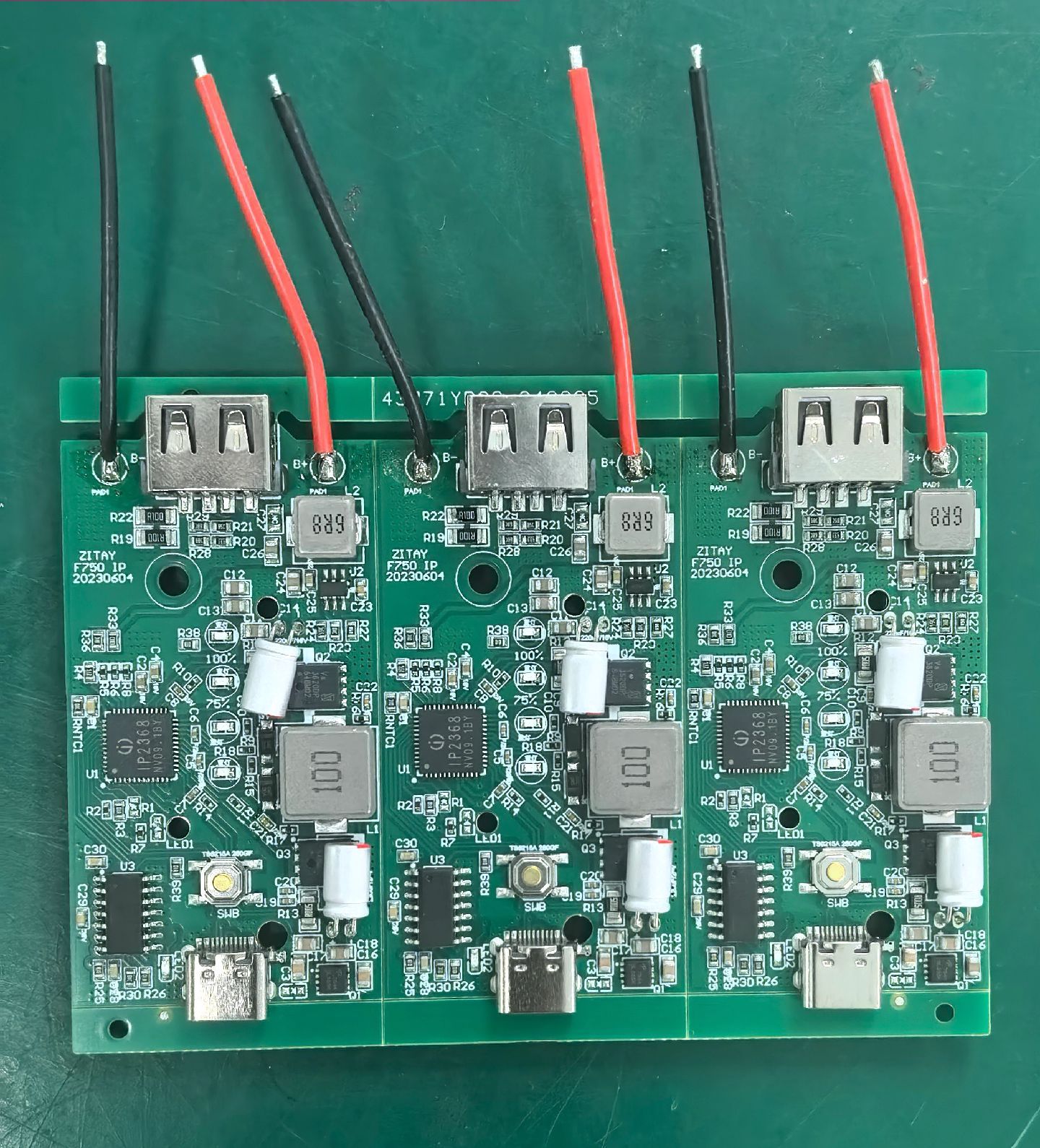

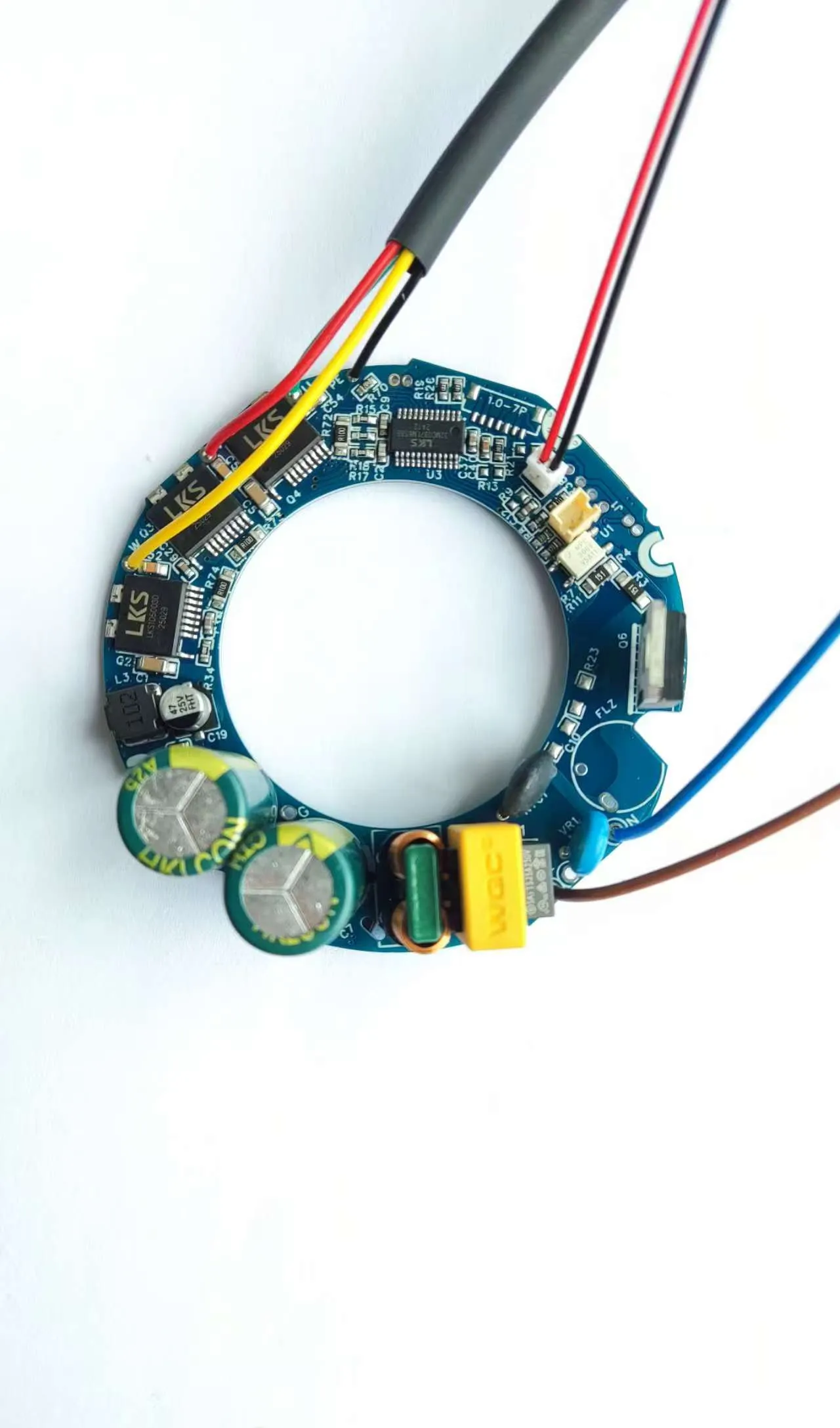

Copper Clad Laminate (CCL) is the core basic material for PCBs, underpinning the development of AI, 6G, data centers and automotive electronics. Driven by high-frequency and high-speed market demand, A-share CCL leading enterprises with technical advantages and industrial chain layout are emerging as core beneficiaries.

Core A-Share CCL Leaders & Core Advantages

✅ Shengyi Technology (600183)

World’s 2nd largest rigid CCL producer (market share >10%); M8/M9 high-end materials mass supply NVIDIA GB300 servers, core beneficiary of AI computing power; 2025 stock price up over 200%.

✅ South Asia New Materials (688519)

Domestic substitution pioneer; high-end high-speed CCL certified by Huawei; 900M RMB capacity expansion for high-frequency products (7.2M sheets/year) for AI/6G; 2025 aerospace revenue +120% YoY.

✅ Huazheng New Materials (603186)

Ultra-low loss materials for 800G optical modules in mass supply; ABF substrate materials enter Huawei supply chain; high-end product ratio rising with obvious valuation advantage.

✅ Jin'an Guoji (002636)

Domestic general FR-4 leader (annual capacity >40M sheets); 6-9% price hike in Dec, benefiting mid-low end price recovery; H1 2025 non-recurring net profit surged 47-63x YoY.

✅ Hongchang Electronics (603002)

Leading epoxy resin for CCL (localization rate >40%); NVIDIA-certified products support high-frequency CCL performance; deep binding with top CCL manufacturers, strong upstream bargaining power.

Hong Kong Stock Core Leader

🏆 Kingboard Laminates (01888.HK)

Global CCL leader with high self-sufficiency of copper foil/glass fiber cloth; H1 2025 net profit +189%-212% YoY; stable supply for domestic AI server manufacturers.

CCL Industry Core Trends

🔹 High-Frequency & High-Speed: AI/6G/data centers drive surging demand for low-DK/DF high-end CCL

🔹 Domestic Substitution: Local enterprises break through high-end barriers, certification and supply chain penetration accelerate

🔹 Industrial Chain Synergy: Vertical layout of key raw materials becomes a core competitive advantage

🔹 Downstream Diversification: Automotive electronics, aerospace and military expand new growth space

Note: Stock investment involves risks, please make decisions based on your own risk tolerance and professional analysis.

10203 View