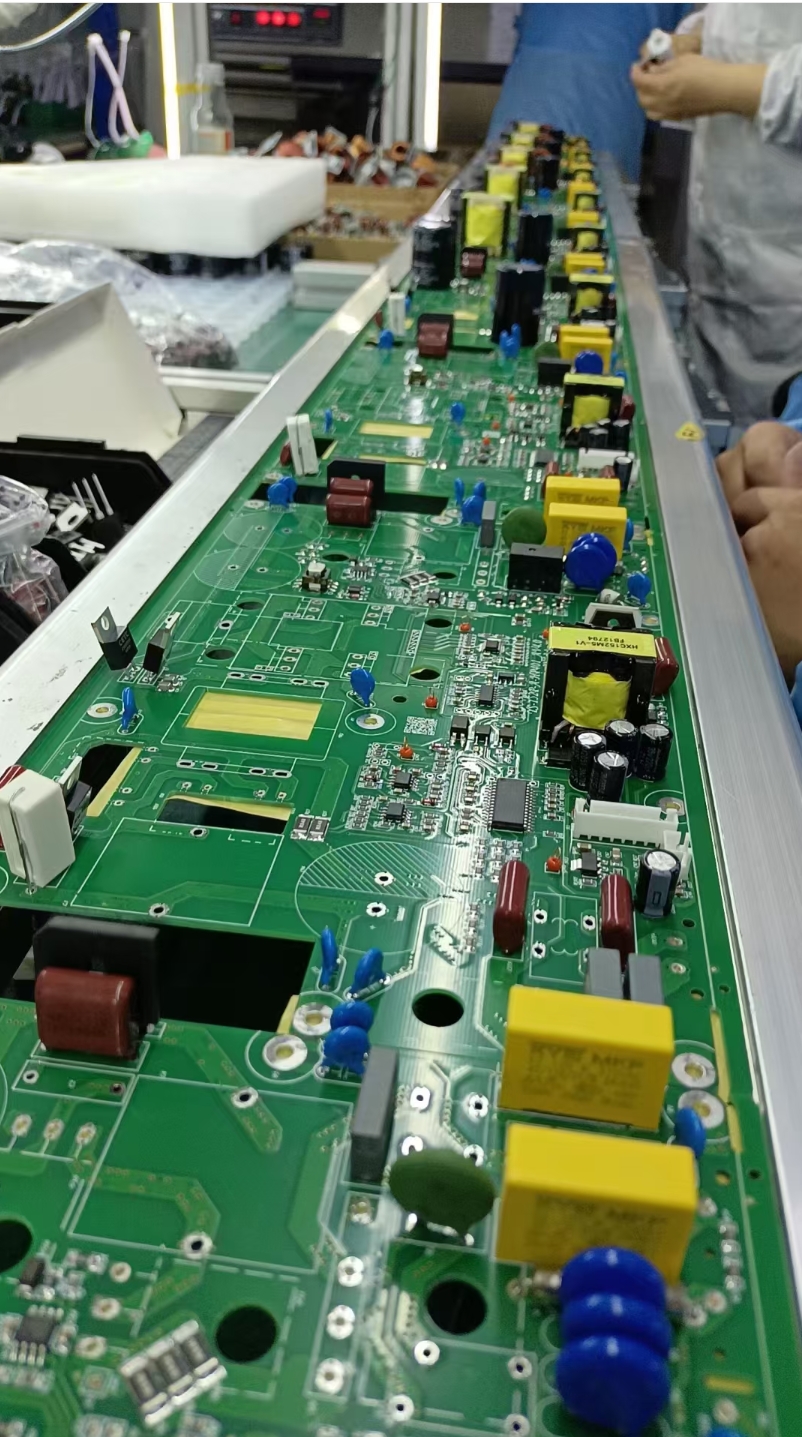

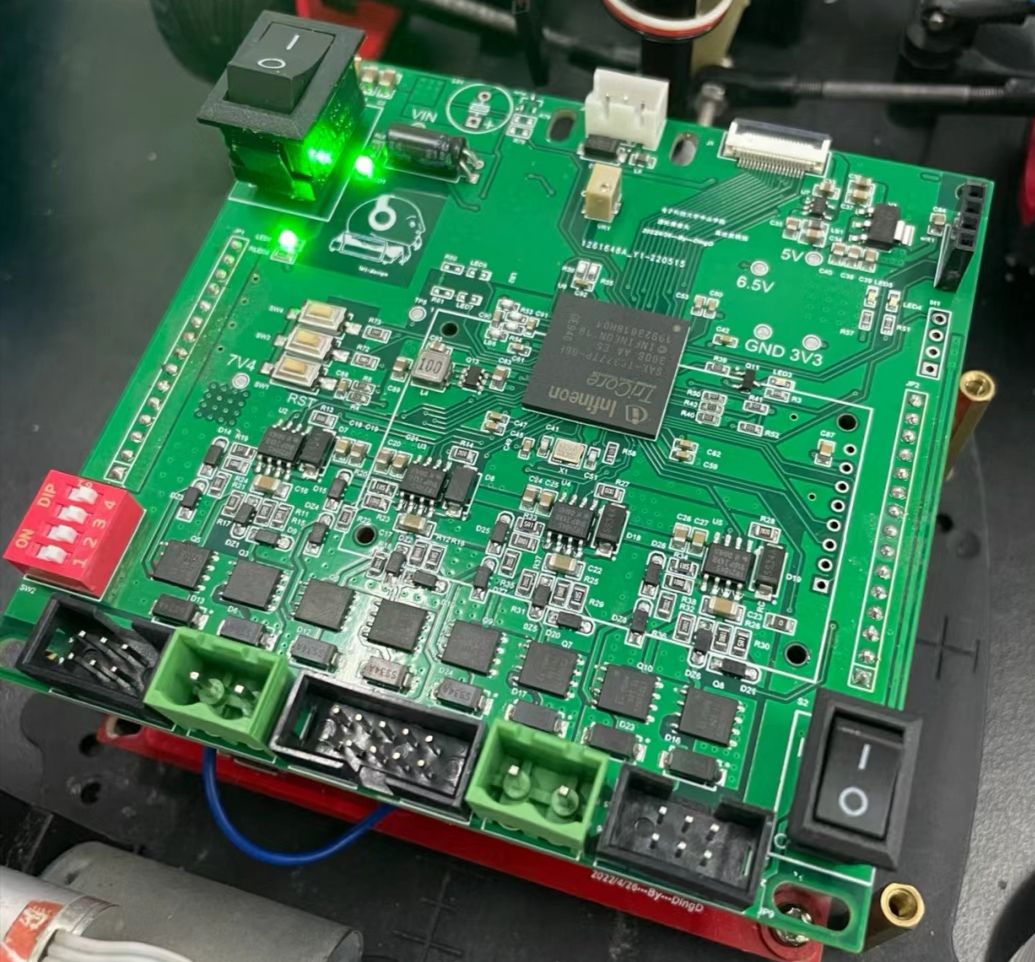

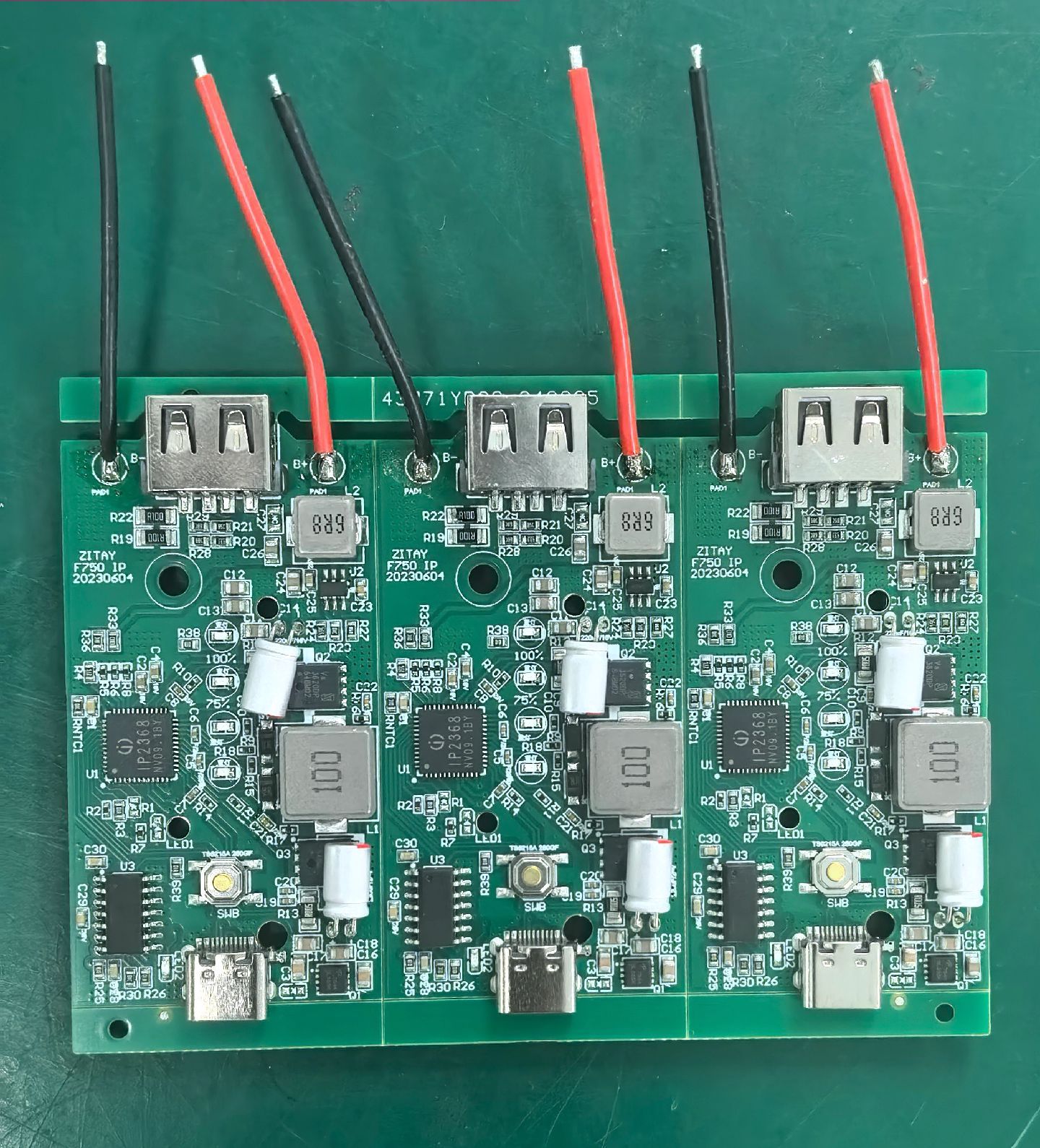

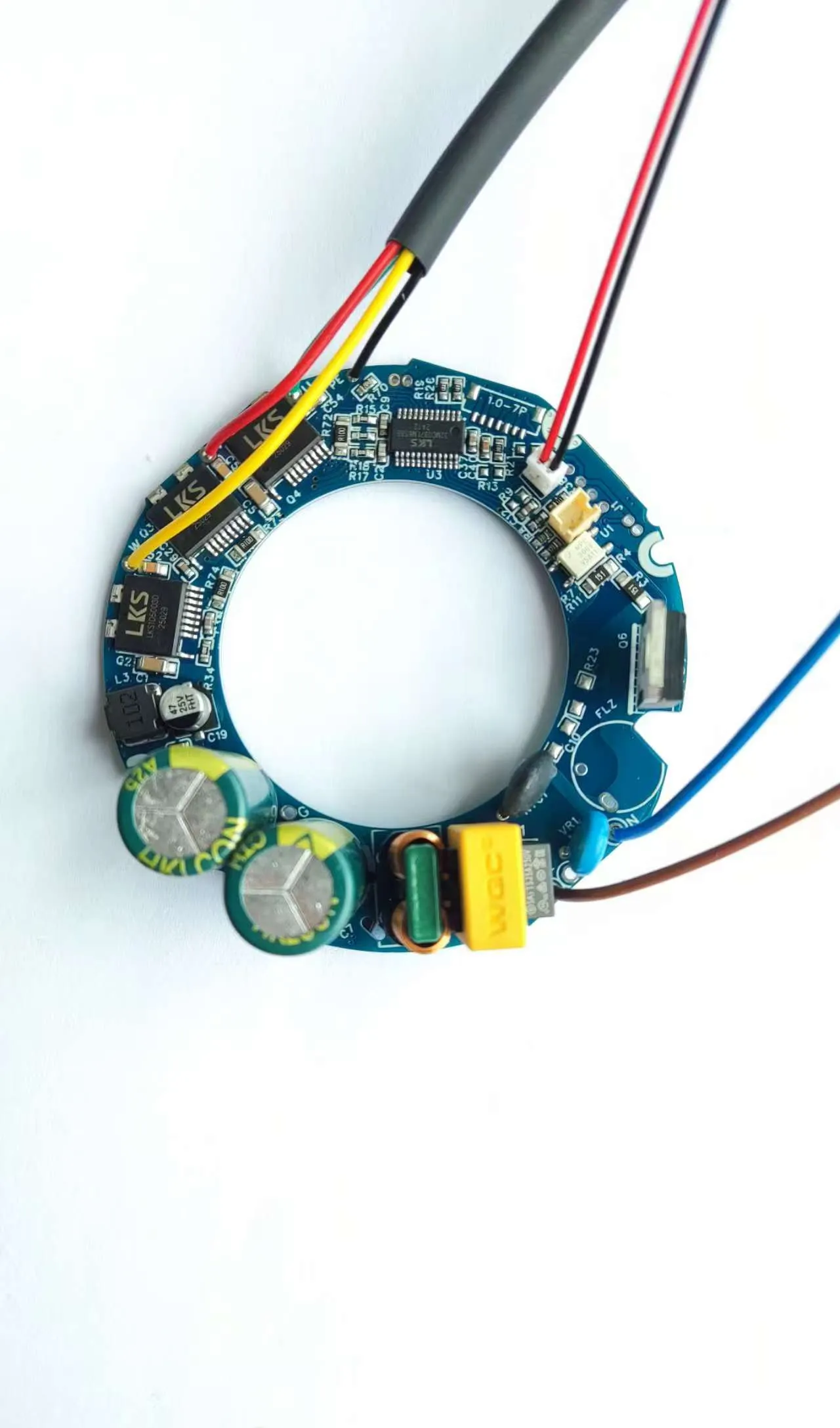

Goldman Sachs has delivered a bombshell forecast for the AI-driven printed circuit board (PCB) and copper-clad laminate (CCL) sectors, ramping up its total addressable market (TAM) projections for 2027 by a wide margin.

Led by analysts Chao Wang and Allen Chang, the team’s January 6, 2026 report on Taiwan’s PCB/CCL industry reveals a dramatic upward revision: AI PCB TAM is now pegged at $26.6 billion, up from the prior $17.4 billion estimate, while AI CCL TAM surges to $18.3 billion from $8 billion. This translates to eye-watering compound annual growth rates (CAGR) of 140% for AI PCBs and 178% for AI CCLs between 2025 and 2027.

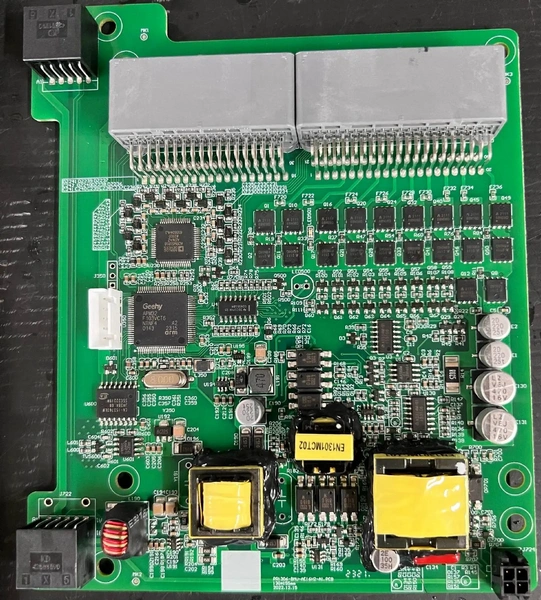

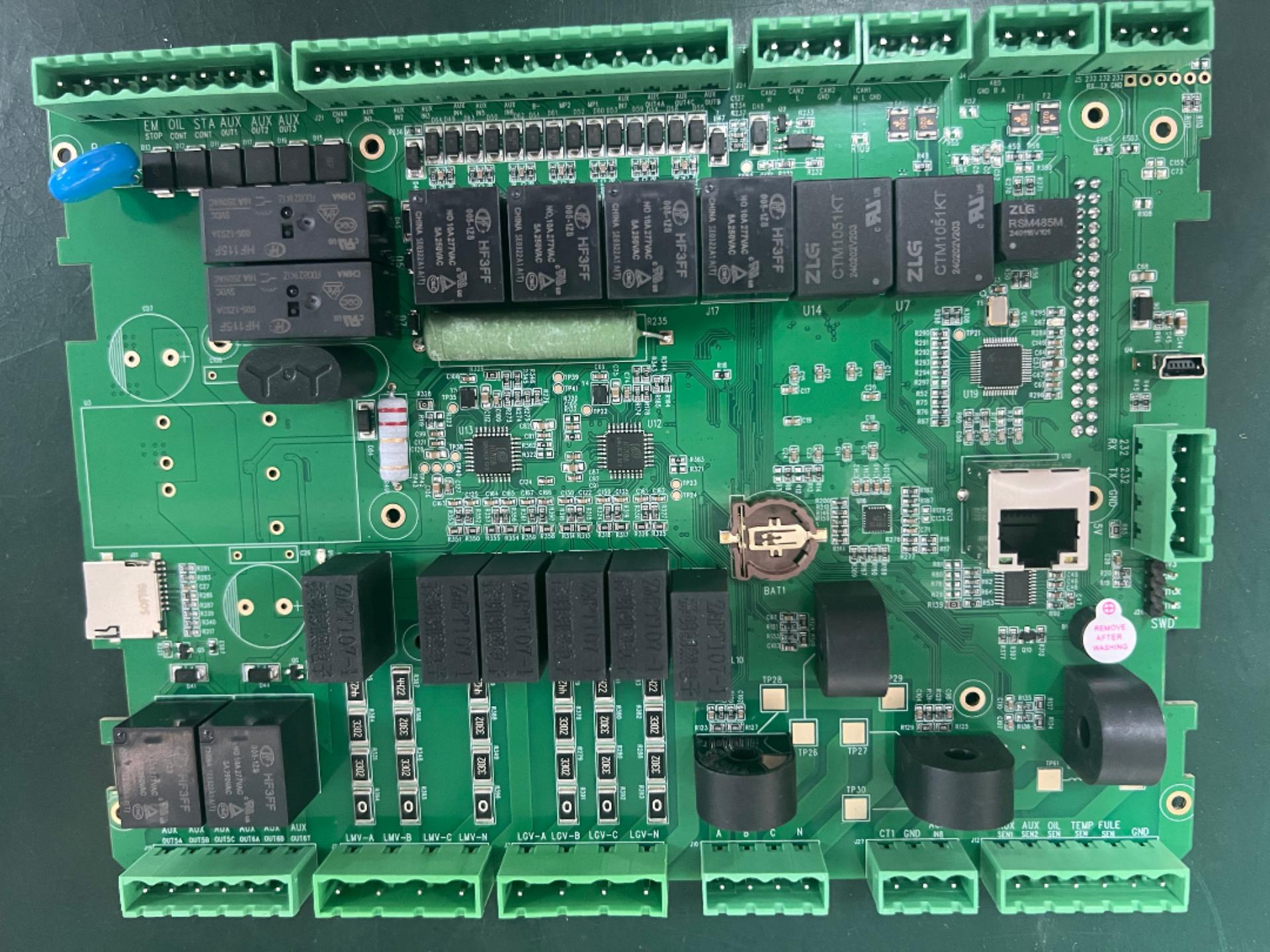

The upgrade is rooted in a pivotal architectural shift rather than linear growth assumptions. NVIDIA’s next-gen VR200/300 rack design is replacing traditional bridge cables with integrated PCB/CCL components, a swap that cuts costs, boosts computing performance, and skyrockets the value per unit of these core parts. Demand for advanced midboards and backplanes is set to explode in H2 2026 and H2 2027, driving a multiplier effect on PCB/CCL value tied to each GPU.

Specification upgrades are also reshaping the landscape: mainstream PCBs will jump from 24–28 layers in 2025 to over 40 layers by 2027, with HDI tech advancing from 4+N+4 to 6+N+6. Higher complexity is squeezing production yields—projected to fall from 73% in 2025 to 62% in 2027—forcing greater CCL usage and pushing the CCL segment’s growth even ahead of PCBs.

For investors, this signals a market shake-up: only top-tier manufacturers capable of navigating low-yield challenges will dominate. While GPU-linked PCB/CCL markets are poised to surge 10-fold and draw more competitors (PCB suppliers to rise from 5 to 10), the ASIC supply chain remains stable. Goldman Sachs stands by its "buy" ratings and raised target prices for Taiwanese leaders EMC, GCE, and TUC—flagging them as the clear winners in the AI infrastructure boom.

Disclaimer: Content and data herein are for reference only and do not constitute investment advice. Verify before use. Risks borne by the user for any actions taken.