Industry Breaking News | Goldman Sachs Aggressively Upsizes AI PCB/CCL Market Forecast, Architecture Transformation Drives Explosive Value Growth

Goldman Sachs' latest research report sends a strong signal: the potential market size (TAM) of AI PCB is projected to surge from $17.4 billion to $26.6 billion by 2027, while the CCL market size will skyrocket from $8 billion to $18.3 billion. The compound annual growth rates (CAGR) from 2025 to 2027 will reach an impressive 140% and 178% respectively.

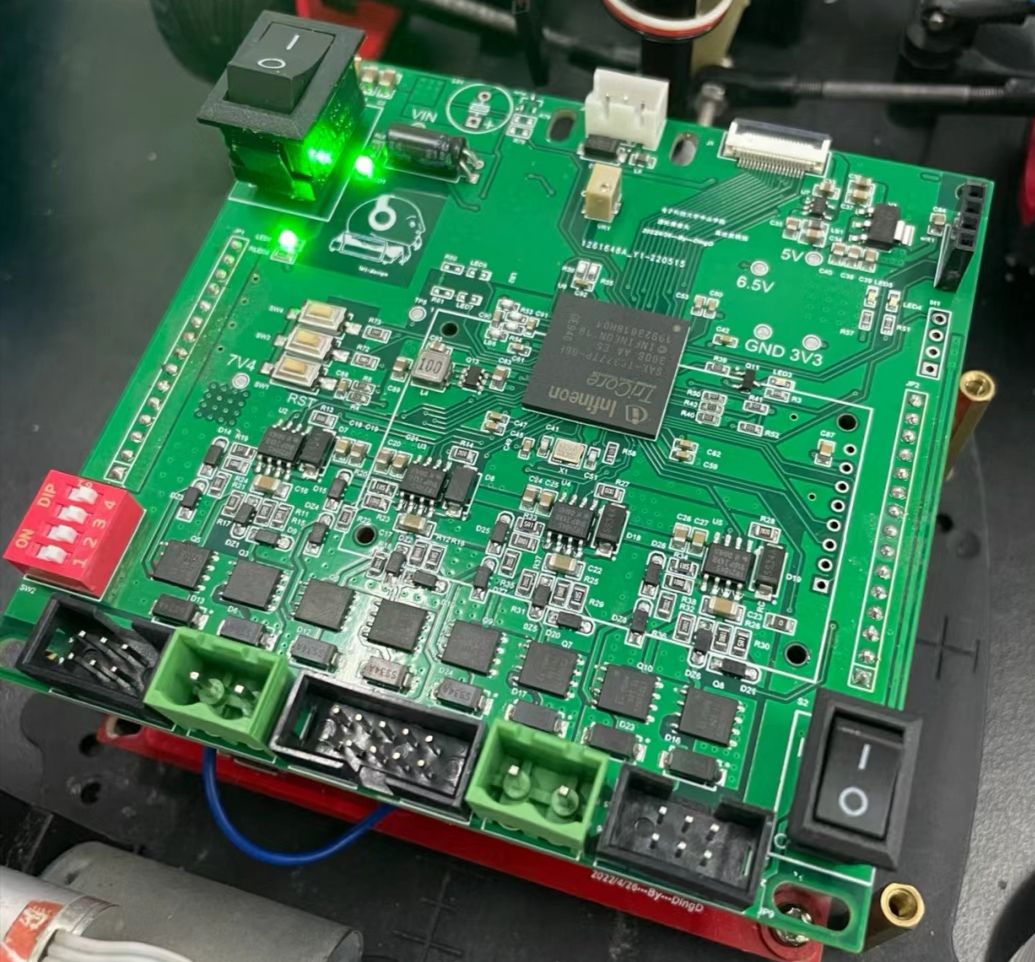

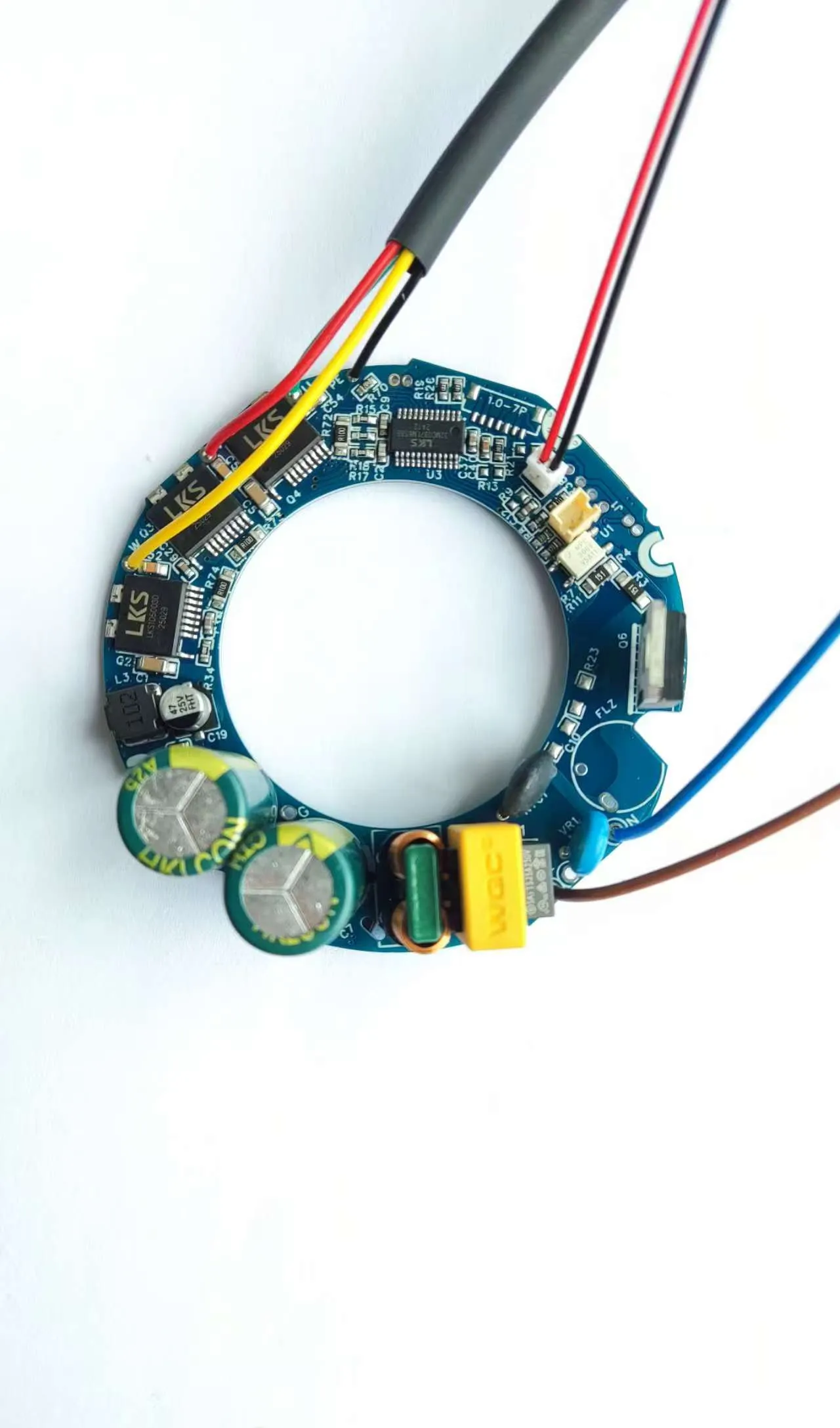

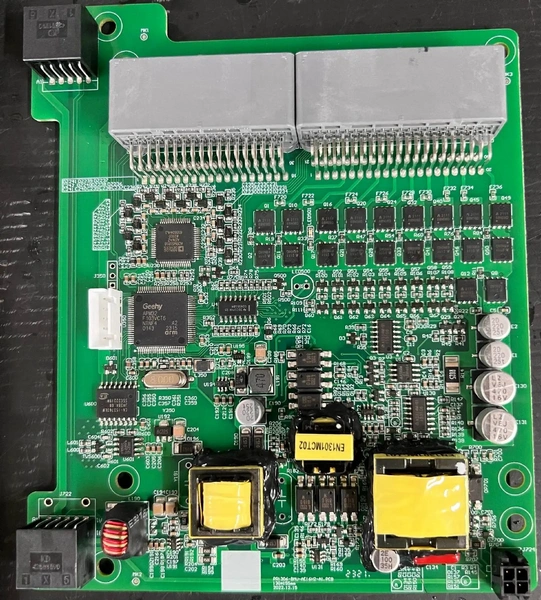

The core logic behind this beyond-expectation upgrade stems from the disruptive transformation of NVIDIA's VR200/300 rack architecture — traditional bridge cables are being replaced by high-performance PCB/CCL components. This shift not only optimizes the cost structure of computing power deployment but also directly ignites the value demand for PCB/CCL.

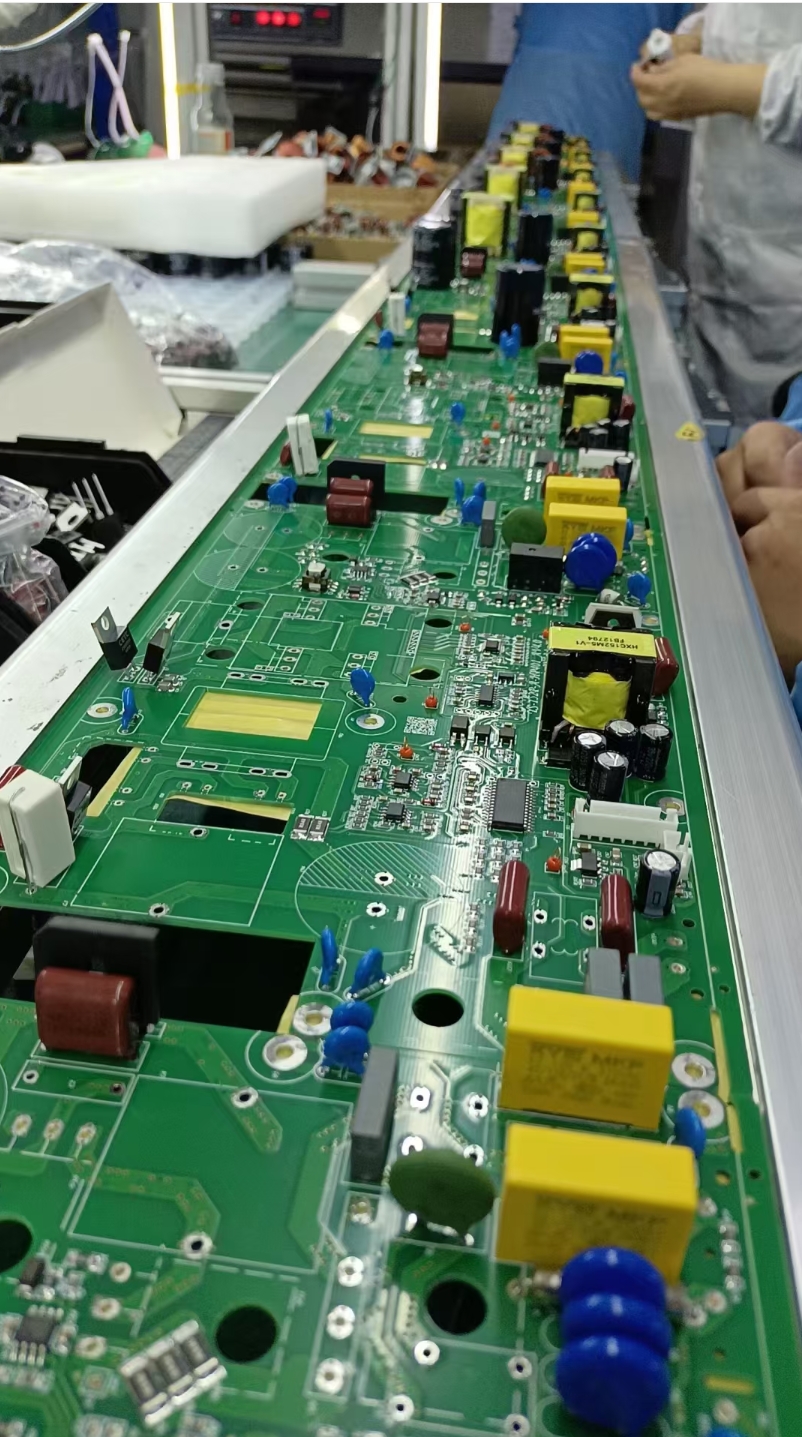

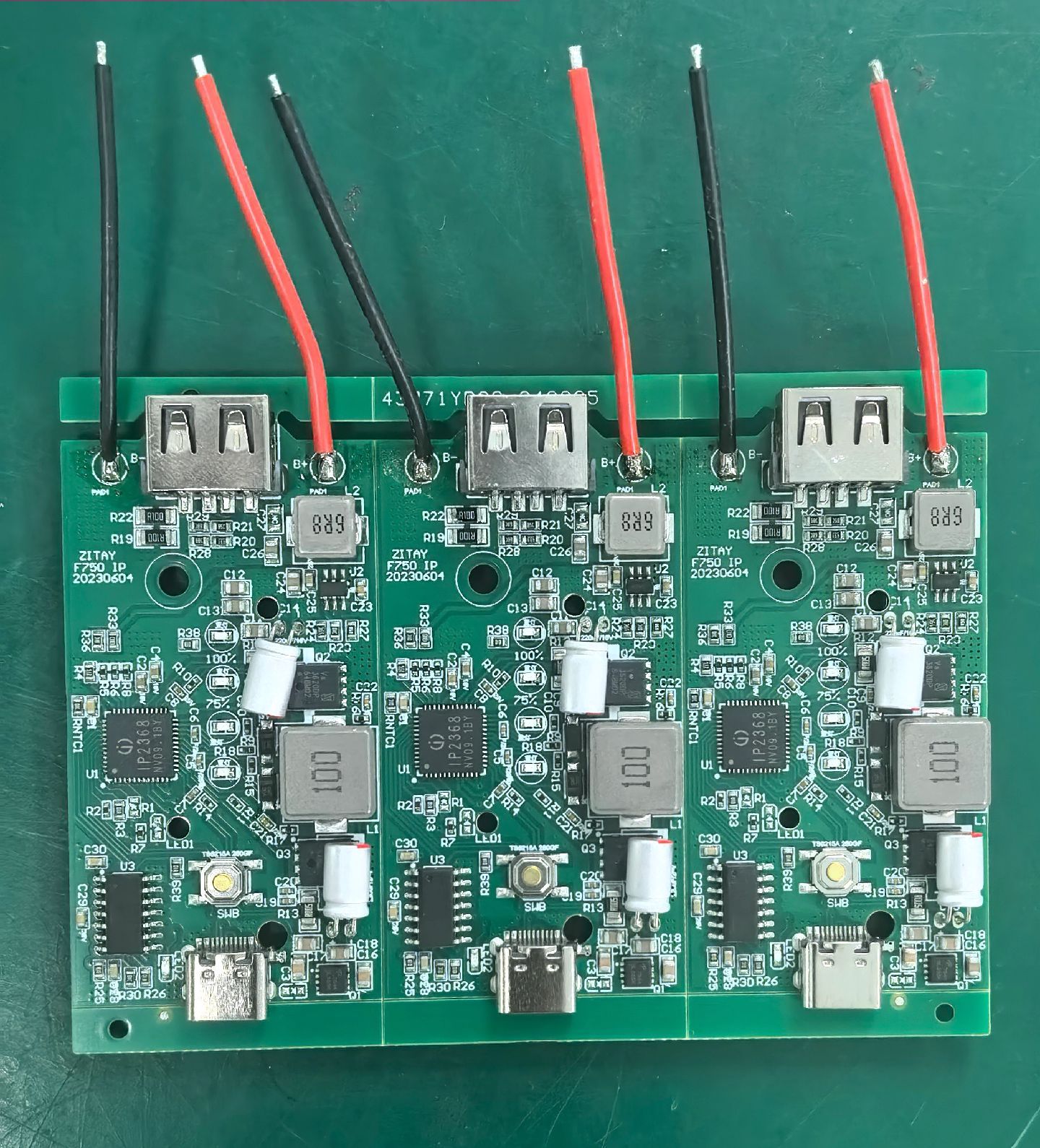

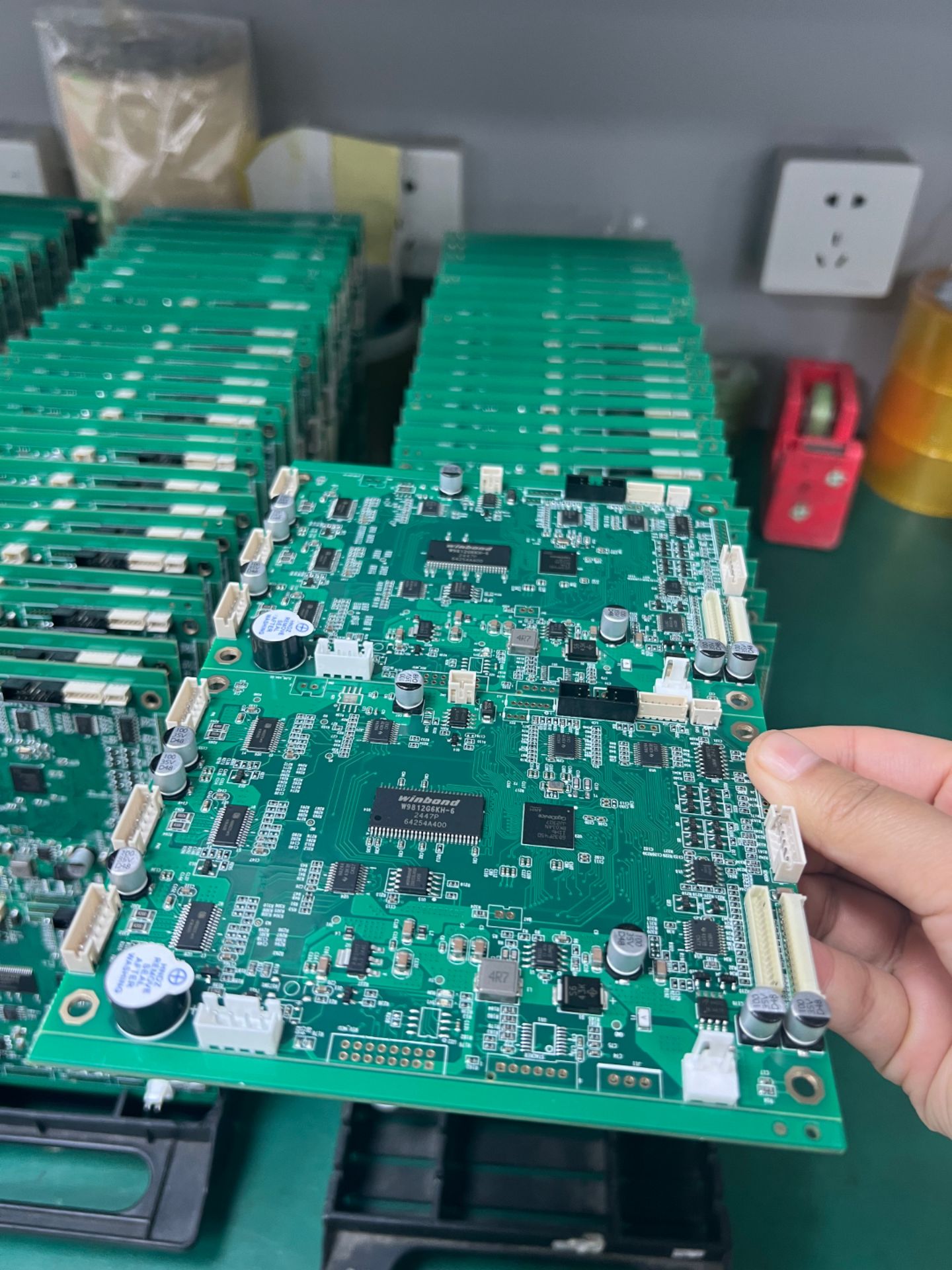

Along with technological iteration, PCB product specifications are undergoing leaping upgrades: the mainstream layer count will exceed 40 by 2027, a significant jump from 24-28 layers in 2025; HDI technology will also evolve from 4+N+4 to 6+N+6, leading to a simultaneous rise in production difficulty and technical barriers. Coupled with the continuous decline in PCB production yield in the coming years (dropping from 73% in 2025 to 62% in 2027), the demand for CCL raw materials will be further amplified, and its market growth rate is expected to outpace that of the PCB market.

Goldman Sachs points out that the AI hardware supply chain is witnessing a qualitative change from "shipment volume growth" to "explosive value growth". The market size of GPU-related PCB/CCL is expected to surge nearly 10 times within two years, and the scale of the ASIC track will also double. Although the number of suppliers in the GPU supply chain is expanding, high-end manufacturers with core technologies will still dominate the market. Goldman Sachs maintains the "buy" rating for leading Taiwanese enterprises such as EMC, GCE and TUC, and raises their target prices across the board.

Amid the wave of AI infrastructure construction, architecture upgrading is reshaping the PCB/CCL industry landscape. High-end manufacturing capabilities and technical reserves will become the core moat for enterprises to seize market dividends.